🔥 Key Takeaways

- Financial analyst Karel Mercx claims the “digital gold” narrative for Bitcoin is broken, citing investors’ preference for physical metals.

- Mercx argues that the economic reality proves investors are choosing traditional safe-haven assets over Bitcoin.

- The analyst’s statement has sparked debate among crypto enthusiasts, with some disagreeing with his assessment.

Gold Bug Who Missed Bitcoin at $400 Claims BTC’s Key Narrative Is Broken

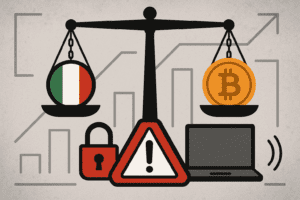

Karel Mercx, a financial analyst and portfolio manager, has made a bold declaration: the “digital gold” debate is over, and Bitcoin has lost. According to Mercx, the economic reality proves that investors are choosing traditional safe-haven assets, such as physical metals, over the “digital experiment” that is Bitcoin.

Mercx’s statement has sparked a heated debate among crypto enthusiasts, with some disagreeing with his assessment. However, Mercx remains convinced that the narrative surrounding Bitcoin as a digital store of value is broken. He points to the fact that investors are increasingly turning to traditional safe-haven assets, such as gold and silver, during times of economic uncertainty.

Missing the Boat on Bitcoin

It’s worth noting that Mercx has a history of being skeptical of Bitcoin. He has previously admitted to missing the boat on the cryptocurrency, failing to invest when it was trading at around $400. Despite this, Mercx remains adamant that his assessment of Bitcoin is correct.

“I don’t think Bitcoin is a viable alternative to traditional safe-haven assets,” Mercx said in a recent interview. “The economic reality proves that investors are choosing physical metals over the digital experiment. The ‘digital gold’ narrative is broken, and it’s time to move on.”

A Broken Narrative?

While Mercx’s statement has sparked debate, it’s worth considering whether the “digital gold” narrative is indeed broken. Bitcoin’s price has been volatile in recent months, and some investors have begun to question its value as a store of wealth.

However, many crypto enthusiasts remain convinced that Bitcoin’s value lies in its decentralized nature and limited supply. They argue that the cryptocurrency is a viable alternative to traditional safe-haven assets, and that its price will continue to rise in the long term.

Conclusion

The debate surrounding Bitcoin’s value as a digital store of wealth is far from over. While Karel Mercx may have declared the “digital gold” narrative broken, many crypto enthusiasts remain convinced that the cryptocurrency has a bright future ahead.

As the economic landscape continues to evolve, it will be interesting to see how investors choose to allocate their assets. Will they follow Mercx’s lead and opt for traditional safe-haven assets, or will they continue to bet on the “digital experiment” that is Bitcoin? Only time will tell.