🔥 Key Takeaways

- Marjorie Taylor Greene’s assertions about a CBDC loophole in the GENIUS Act lack legal grounding.

- Regulatory experts emphasize the importance of clear definitions in legislation.

- The ongoing debate surrounding Central Bank Digital Currencies (CBDCs) continues to shape public and political discourse.

The Landscape of CBDCs and Regulatory Implications

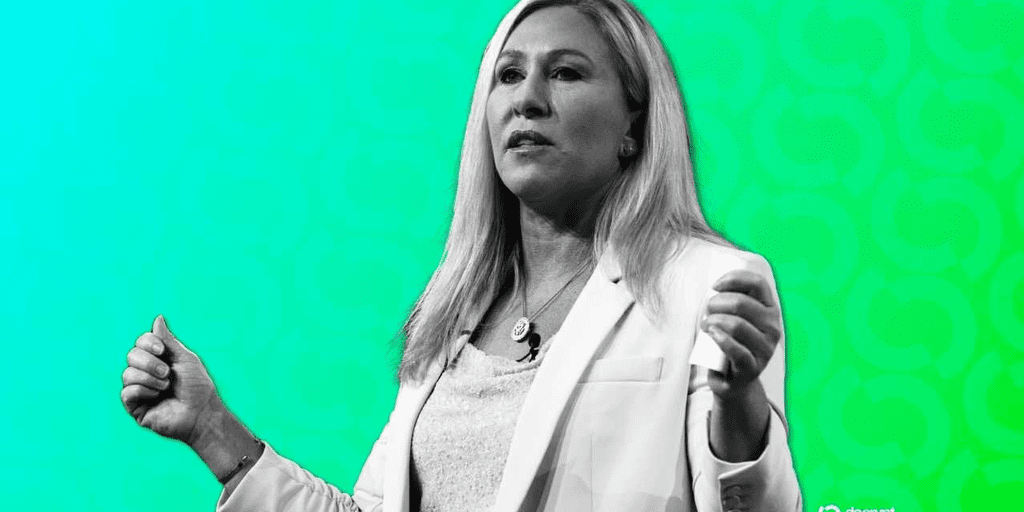

The recent claims by Representative Marjorie Taylor Greene regarding a supposed loophole in the GENIUS Act relating to Central Bank Digital Currencies (CBDCs) have sparked significant discussion within the financial and regulatory communities. A regulatory attorney’s assessment, as reported by Decrypt, suggests that Greene’s statements lack substantive legal backing. This raises essential questions about the clarity and intent behind current and proposed legislation regarding CBDCs.

Why It Matters

The discourse around CBDCs is not merely academic; it has real implications for the future of financial systems. As governments worldwide explore the integration of digital currencies into their economies, clarity in legislative language becomes paramount. Misinterpretations or ambiguous clauses can lead to public confusion, potential market instability, and hindered innovation in the crypto space. The ongoing discussions underscore the necessity for stakeholders, including lawmakers, regulators, and the public, to engage in informed dialogues about the future of money.

Evaluating the Claims

Greene’s comments reflect a broader skepticism about government-issued digital currencies. While many proponents argue that CBDCs can enhance financial inclusion and streamline transactions, critics like Greene raise concerns over privacy and governmental control. However, the assertion of a loophole indicates a misunderstanding of the legislative framework. Regulatory experts stress that for a loophole to exist, there must be an ambiguous or contradictory provision within the law, which in this case, appears to be unfounded.

Looking Ahead

The ongoing evolution of digital currencies necessitates a proactive approach from regulators and policymakers. As the conversation surrounding CBDCs continues to gain traction, it is crucial for lawmakers to ensure that any proposed legislation is precise and comprehensible. This will not only facilitate a smoother integration of CBDCs into the financial landscape but also foster trust among the public and market participants. The future of finance will likely involve a blend of traditional and digital currencies, making it essential for regulatory frameworks to evolve in tandem with technological advancements.

As the debate unfolds, stakeholders should remain vigilant and engaged. The implications of CBDCs extend far beyond the realm of finance; they touch upon privacy, security, and the fundamental nature of currency itself. For more information on CBDCs and their potential impacts, consider visiting Investopedia or the Brookings Institution.