🔥 Key Takeaways

- Trump’s renewed tensions with Powell could complicate the upcoming FOMC meeting.

- Recent economic indicators show a mixed bag, suggesting a cautious Fed approach.

- The political landscape is increasingly influencing monetary policy, heightening market volatility.

Trump’s Influence on Powell and the FOMC: A Political Gamechanger?

The ongoing friction between former President Donald Trump and Federal Reserve Chair Jerome Powell is resurfacing just as the Federal Open Market Committee (FOMC) gears up for its pivotal December meeting. With a backdrop of lukewarm labor statistics, inconsistent Purchasing Managers’ Index (PMI) data, and a Federal Reserve that appears to be retreating from its quantitative tightening stance, the tension between politics and monetary policy is once again becoming a critical focal point.

The Current Economic Context

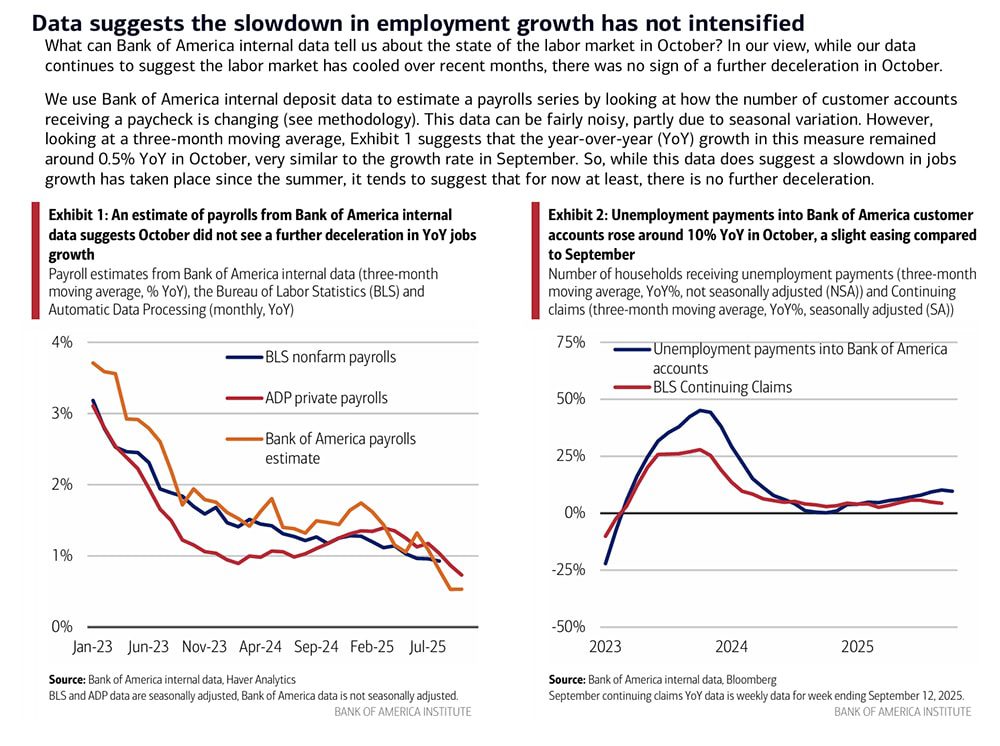

The latest reports on non-farm payrolls and jobless claims present a nuanced narrative. Weaker labor data may suggest a slowing economy, prompting the Fed to reconsider its recent trajectory. Meanwhile, PMI figures reflect an uneven recovery, indicating that while some sectors are thriving, others are struggling to regain momentum. This mixed economic landscape sets the stage for the FOMC’s upcoming decision-making process, placing immense pressure on Powell’s leadership.

Political Implications for the Federal Reserve

The potential for Trump to leverage his influence over the Fed adds another layer of complexity. Should he express a desire to veto Powell’s leadership amid the December meeting, it could unleash significant uncertainty in financial markets. Historically, political pressures have often swayed central bank decisions, and Trump’s vocal opposition to Powell could tilt the balance toward more hawkish policies.

Why It Matters

The intersection of politics and monetary policy is a crucial element to monitor, particularly in the context of cryptocurrencies. A strong indication of direction from the Fed—whether it leans toward tightening or easing—will have profound implications for digital asset valuations. In a volatile market, any shifts or perceived shifts in Fed policy can trigger rapid market reactions, influencing both institutional and retail investor behavior.

As we approach the FOMC meeting, participants in the cryptocurrency space should remain vigilant to both economic indicators and political developments. The ongoing narrative around Trump and Powell serves as a potent reminder of the broader impacts of governance on financial ecosystems, including the nascent crypto market.