🔥 Key Takeaways

- Animoca and Solv are collaborating to boost yield generation for Japanese Bitcoin firms.

- Solv’s approach includes leveraging lending markets and automated market maker pools.

- This partnership reflects the growing trend of institutional interest in Bitcoin and yield-generating strategies.

Strategic Collaboration to Enhance Yield Generation

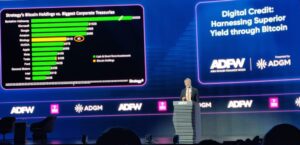

The collaboration between Animoca Brands and Solv marks a significant step forward for Bitcoin companies in Japan, who are increasingly seeking innovative methods to generate yield on their assets. This partnership aims to harness Solv’s expertise in yield generation through various financial mechanisms, including lending markets, liquidity provisioning to automated market maker (AMM) pools, and participation in structured staking programs. By doing so, they not only enhance the utility of Bitcoin for these firms but also contribute to the broader ecosystem of digital finance in Japan.

Why It Matters

This initiative is particularly noteworthy as it underscores the increasing institutional interest in Bitcoin beyond mere speculation. The Japanese market, known for its regulatory rigor, is now opening its doors to more sophisticated financial instruments and services. By facilitating yield generation, Animoca and Solv are enabling companies to leverage their Bitcoin holdings more effectively, thus fostering a healthier crypto economy. This partnership also reflects a wider global trend where businesses are looking to optimize their digital asset portfolios in response to market volatility and the quest for sustainable revenue streams.

The Future of Bitcoin Yield Generation

The use of yield generation strategies is not just a passing trend; it represents a fundamental shift in how Bitcoin and other cryptocurrencies are perceived and utilized within the financial landscape. As firms like Solv continue to innovate in the yield space, it could lead to the emergence of new financial products that cater specifically to the needs of institutional investors. Moreover, as this partnership gains traction, it may pave the way for other collaborations, further enhancing the competitive landscape of the crypto market in Japan and potentially influencing global strategies.

In conclusion, the collaboration between Animoca and Solv not only serves the immediate goal of yield generation for Japanese Bitcoin companies but also reflects a broader movement toward the institutionalization of cryptocurrencies. As more firms adopt these practices, we can expect to see an evolution in both the regulatory environment and the technological infrastructure supporting digital assets.