🔥 Key Takeaways

Analyzing the Impact of Whale Activity on XRP’s Market Dynamics

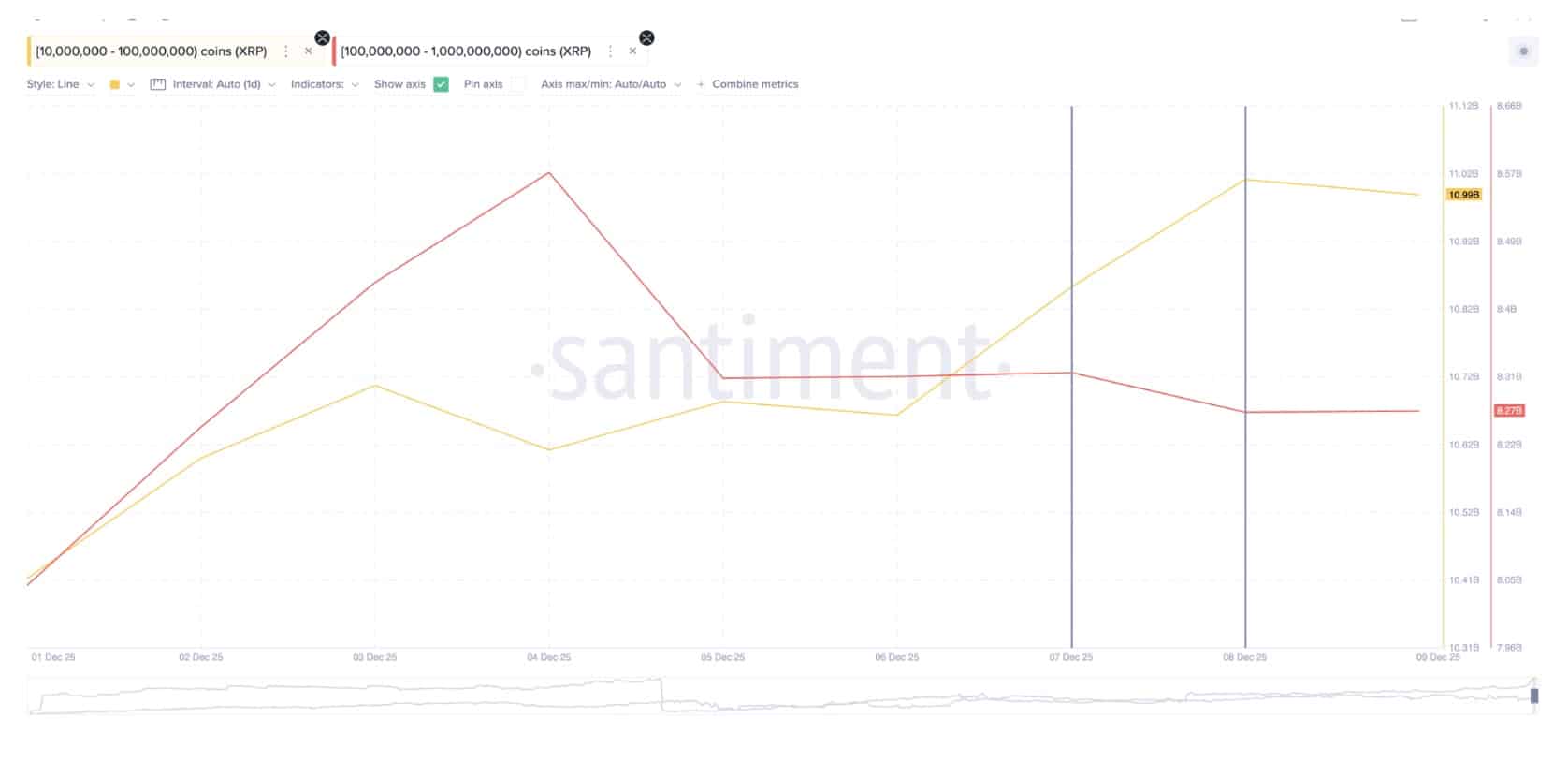

The recent selling spree by XRP whales has raised eyebrows within the crypto community, particularly as it coincides with a critical moment for the cryptocurrency. With over $700 million worth of XRP sold since December 5, the question arises: are these large holders hindering XRP’s potential to break above the significant $2 resistance level? This analysis delves into the underlying factors influencing this situation and what it means for investors moving forward.

Understanding Whale Behavior

Whales, or large holders of cryptocurrencies, play a pivotal role in market dynamics. Their ability to influence price movements can create volatility, as their selling or buying decisions can shift supply and demand equations dramatically. In the case of XRP, the recent offloading of tokens by these whales seems to align with strategic timing ahead of the FOMC meeting, where economic indicators could alter market sentiment significantly.

The data from Santiment highlights a concerning trend for XRP’s immediate price performance. With whales liquidating substantial amounts, the market has experienced increased selling pressure, which could serve to suppress bullish momentum. However, it is essential to contextualize this activity; many long-term holders have opted to maintain their positions, suggesting a divergence between short-term and long-term market sentiment.

Why It Matters

The ability of XRP to break above the $2 mark is crucial for its recovery trajectory. This resistance level is not just a psychological barrier but also a technical one, serving as a potential catalyst for further bullish movements if overcome. The ongoing selling pressure from whales could delay this breakout, leading to a prolonged consolidation phase. However, the resilience of long-term holders indicates a strong underlying belief in XRP’s future potential, which could stabilize the price in the face of whale-induced volatility.

Moreover, the uncertainty surrounding the FOMC meeting adds another layer of complexity. Market participants are likely to be cautious, awaiting signals that could impact broader market conditions and, by extension, the price of XRP. This situation illustrates the dual nature of cryptocurrency investment—balancing immediate reactions to market movements against long-term strategies based on fundamental beliefs.

Conclusion: Navigating the Future of XRP

In conclusion, while the recent actions of XRP whales present challenges, they also highlight the complexities of market behavior in the cryptocurrency space. The continued support from long-term holders provides a counterbalance to the selling pressure, suggesting that optimism for XRP’s future remains intact. Investors should monitor the upcoming FOMC meeting closely, as its outcomes could significantly influence XRP’s ability to navigate past resistance levels and establish a more robust recovery path.

![[LIVE] Crypto News Today: Latest Updates for Jan. 21, 2026 – BTC Falls 4%, ETH Slides 7% Under $3,000 on Trump Tariff Threats](https://cryptoepochs.com/wp-content/uploads/2026/01/img_1768970849.avif)