🔥 Key Takeaways

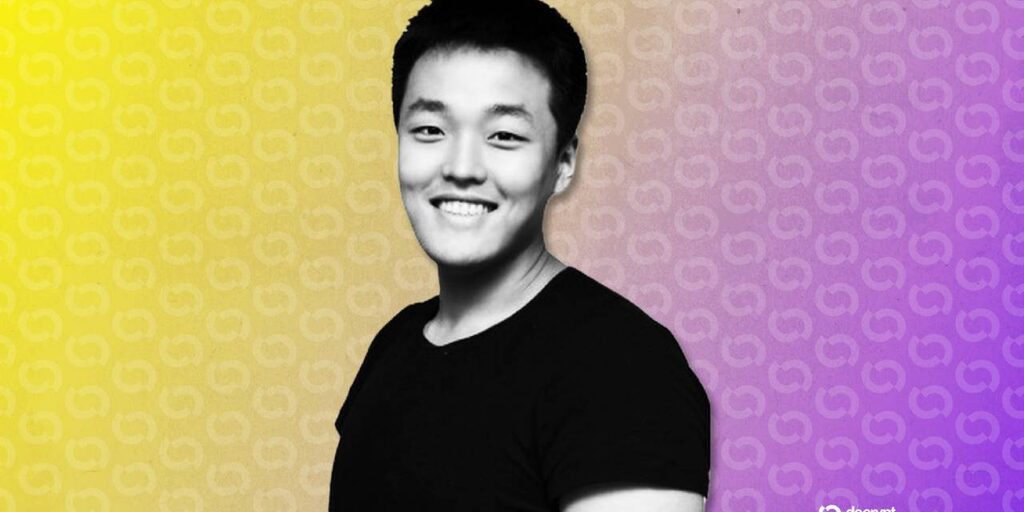

- Do Kwon, founder of Terraform Labs, faces sentencing for investor fraud.

- This case highlights regulatory scrutiny in the crypto space.

- Market reactions to Kwon’s legal outcomes may influence investor sentiment.

Contextual Overview of the Sentencing

Today marks a significant moment in the world of cryptocurrency as Do Kwon, the controversial founder of Terraform Labs, faces sentencing for his role in defrauding investors. In August, Kwon pleaded guilty to the charges, which stemmed from the catastrophic collapse of the Terra ecosystem in 2022. The fallout from this incident has been extensive, with billions of dollars in losses and a shaken confidence among retail and institutional investors alike.

Why It Matters

The sentencing of Kwon is not just a personal consequence for the founder but a critical juncture for the entire cryptocurrency ecosystem. As regulatory bodies around the world tighten their grip on the industry, Kwon’s case serves as a bellwether for future legal actions against crypto executives. The outcome may influence not only the sentiment of investors but also the regulatory landscape as governments seek to establish clearer guidelines for the burgeoning sector. Investors will be closely watching how the judicial system handles such high-profile cases, which could set precedents for accountability and governance in crypto.

Market Implications

The ramifications of Kwon’s sentencing could reverberate across the cryptocurrency market. Should the court impose a severe penalty, it could deter potential entrepreneurs from engaging in similar ventures, fearing legal repercussions. Conversely, a lenient sentence might embolden others to disregard regulatory concerns, believing that the potential rewards outweigh the risks. Additionally, investors may react to the news with volatility; a strong reaction could lead to a temporary dip in the market, particularly affecting stablecoins and projects associated with Terraform Labs.

Moreover, this incident underscores a broader trend of increasing regulatory scrutiny in the crypto space. Governments are not only looking at investor protections but are also beginning to explore how to deal with the implications of decentralized finance and the risks it poses to the traditional financial system. As such, this case might stimulate further discussions in legislative bodies about how to effectively regulate digital currencies without stifling innovation.

As we await the court’s decision, all eyes will be on the immediate market reactions and long-term implications for the crypto landscape. Kwon’s fate could very well serve as a litmus test for the evolving relationship between cryptocurrency and regulatory frameworks globally.