🔥 Key Takeaways

- A heated debate between Peter Schiff and CZ highlights divergent views on Bitcoin and gold’s roles in the financial system.

- Schiff argues that Bitcoin payments represent nothing more than “liquidated bets,” undermining Bitcoin’s credibility as a currency.

- The discussion reflects broader tensions in cryptocurrency adoption and the ongoing quest for a reliable store of value.

The Context of the Debate

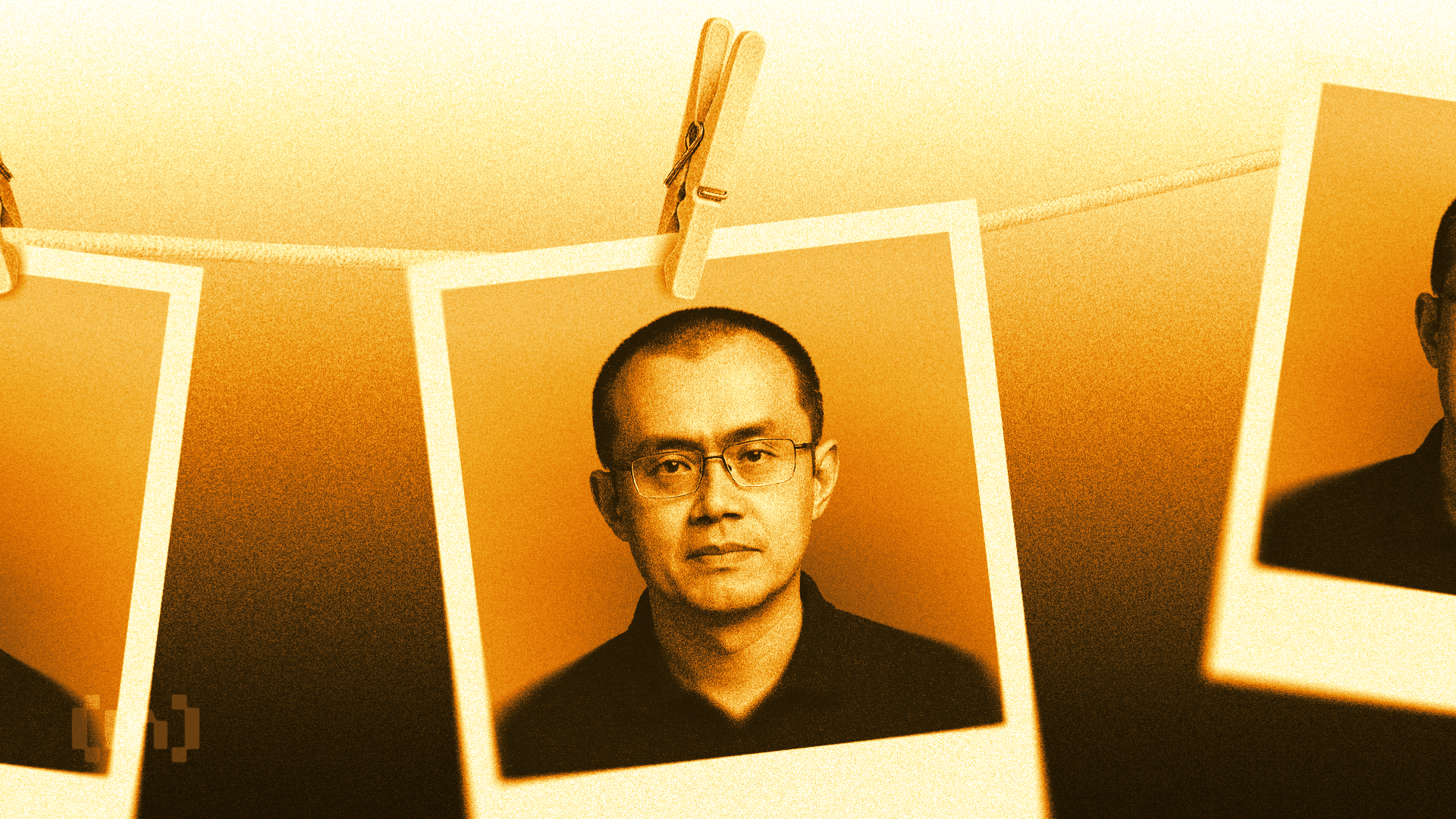

The recent brawl of ideologies at the Binance Blockchain Week in Dubai between prominent advocates of Bitcoin and gold underscores the fundamental divisions that continue to shape the crypto landscape. Peter Schiff, a long-time critic of Bitcoin, took to the stage to confront Changpeng Zhao (CZ), the founder of Binance, in a dialogue that delved deeply into the essence of what constitutes “money” in today’s rapidly evolving financial ecosystem. Schiff’s assertion that Bitcoin payments are merely “liquidated bets” brings forth a critical examination of Bitcoin’s utility as a medium of exchange and a reliable store of value.

The Utility of Bitcoin vs. Tokenized Gold

The core of Schiff’s argument rests on his belief that Bitcoin lacks intrinsic value, positioning it instead as a speculative asset vulnerable to market volatility. He emphasizes that transactions made with Bitcoin are more akin to trading positions than genuine exchanges of value. In this light, Bitcoin may fail to fulfill the criteria of a stable medium of exchange—a characteristic that has historically anchored gold’s status in the financial world.

Conversely, CZ defended Bitcoin’s transformative potential, arguing that its decentralized nature, security features, and growing adoption present a formidable alternative to traditional assets like gold. He posits that Bitcoin can achieve mainstream acceptance as a transactional currency, especially as technological advancements continue to enhance its scalability and usability.

Why It Matters

This debate not only spotlights the contrasting perspectives of two influential figures in the financial sphere but also illustrates the broader implications for the cryptocurrency market as a whole. As digital assets increasingly vie for legitimacy and utility in global finance, public discourse around their fundamental roles will shape regulatory responses, investment strategies, and consumer adoption rates.

The outcome of this ideological clash could very well influence the future trajectory of Bitcoin and its competitors, including tokenized gold products. If consumers view Bitcoin predominantly as a speculative instrument rather than a legitimate currency, this perception may hinder its mass adoption. On the other hand, should it gain traction as a valid medium of exchange, it might redefine the landscape of money and financial transactions.

Looking Ahead

As we move further into 2025, the ramifications of this debate are likely to reverberate across both the crypto and traditional financial markets. Observers will be keenly watching how Bitcoin evolves in response to such critiques and whether it can solidify its position as a trusted store of value amidst the ongoing competition from gold and other emerging financial instruments. The dialogue between Schiff and CZ may serve as a microcosm of the larger narrative surrounding the evolving definition of money in a digitized world.