🔥 Key Takeaways

- Jensen Huang predicts AI could propel global GDP to $500 trillion.

- Economists express skepticism regarding such exponential growth.

- The implications for tech investment and crypto markets could be profound.

Understanding Jensen Huang’s Bold Prediction on AI and Global GDP

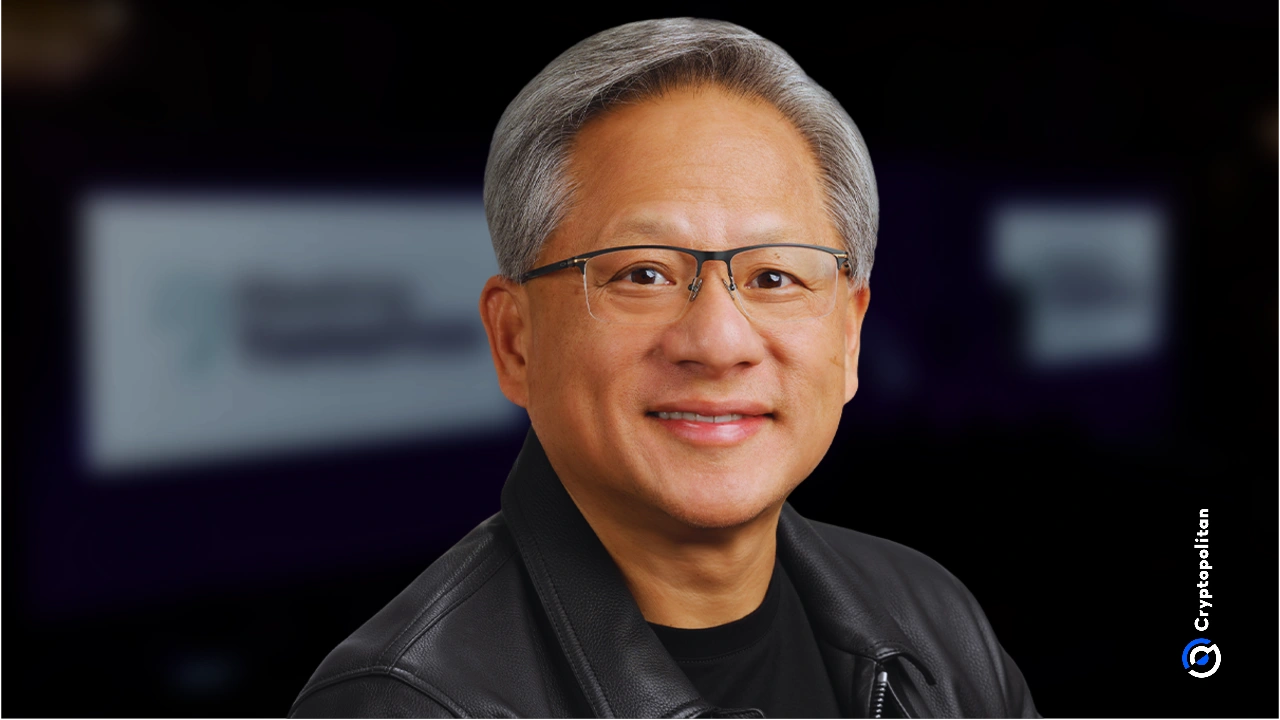

In a striking assertion, Jensen Huang, the visionary CEO of Nvidia, has declared that the rise of artificial intelligence (AI) could potentially inflate global output from its current level of approximately $100 trillion to an astonishing $500 trillion. This bold statement, featured in a recent TIME Magazine article recognizing the ‘Architects of AI’, has sparked both intrigue and skepticism among economists and market analysts alike.

The Skepticism Surrounding Exponential Growth

While Huang’s optimism reflects a growing belief in the transformative potential of AI technologies, many economists remain unconvinced. They argue that such an increase in GDP is not merely a function of technological advancement but also depends on various socio-economic factors including labor markets, regulatory environments, and global trade dynamics. The leap from $100 trillion to $500 trillion represents a staggering 500% growth, raising questions about the feasibility of such an exponential increase in output. It is crucial to analyze whether technological advancements can indeed create new markets and industries at a pace that justifies this projection.

Why It Matters

The implications of Huang’s forecast extend beyond traditional economic measures. If AI can genuinely drive such growth, it could redefine investment strategies across various sectors, including the crypto market. Increased economic productivity may lead to a heightened demand for digital assets as investors look for new avenues to capitalize on technological advancements. This could further legitimize cryptocurrencies as integral components of the modern financial landscape. Furthermore, as AI drives efficiencies and innovations, industries that integrate these technologies may witness unprecedented growth, attracting significant capital inflows.

The Future of Technology and Investment

The intersection of AI and cryptocurrency is particularly noteworthy. As AI systems become more prevalent, they could influence market behaviors, automate trading, and even enhance security measures in blockchain technologies. Nvidia’s advancements in AI could empower crypto projects, enabling faster transaction processing and improved network security, thus making cryptocurrencies more appealing to both retail and institutional investors. Such developments could lead to a new era where digital currencies are not just speculative assets but essential tools for conducting business.

In conclusion, while Huang’s ambitious prediction may raise eyebrows, it also opens the door to a larger conversation about the future of technology and its role in shaping global economies. Whether or not the world reaches a $500 trillion GDP, the impact of AI on productivity, investment, and the evolution of the crypto market is undeniable and warrants close attention.