🔥 Key Takeaways

The Implications of the U.S. Government Shutdown on Crypto Markets

The early days of November saw the crypto market grappling with the repercussions of one of the longest U.S. government shutdowns in recent history. As the shutdown extended beyond typical durations, investor sentiment soured, triggering heightened levels of fear within the broader financial ecosystem. This event has underscored the interconnectedness of traditional finance and the cryptocurrency market, revealing how external political developments can induce significant shifts in market dynamics.

Why It Matters

The importance of the shutdown extends beyond mere headlines; it reflects a critical juncture for economic actors, including a vast number of federal employees who have been placed on unpaid leave. The economic repercussions are palpable, as consumer spending—predicated on disposable income—takes a hit. When federal employees, who are typically stable earners, face financial uncertainty, it can lead to diminished spending power and subsequent reduced demand for various assets, including cryptocurrencies. This downturn creates a feedback loop that compounds market apprehensions, potentially stalling recovery efforts in segments that are already struggling.

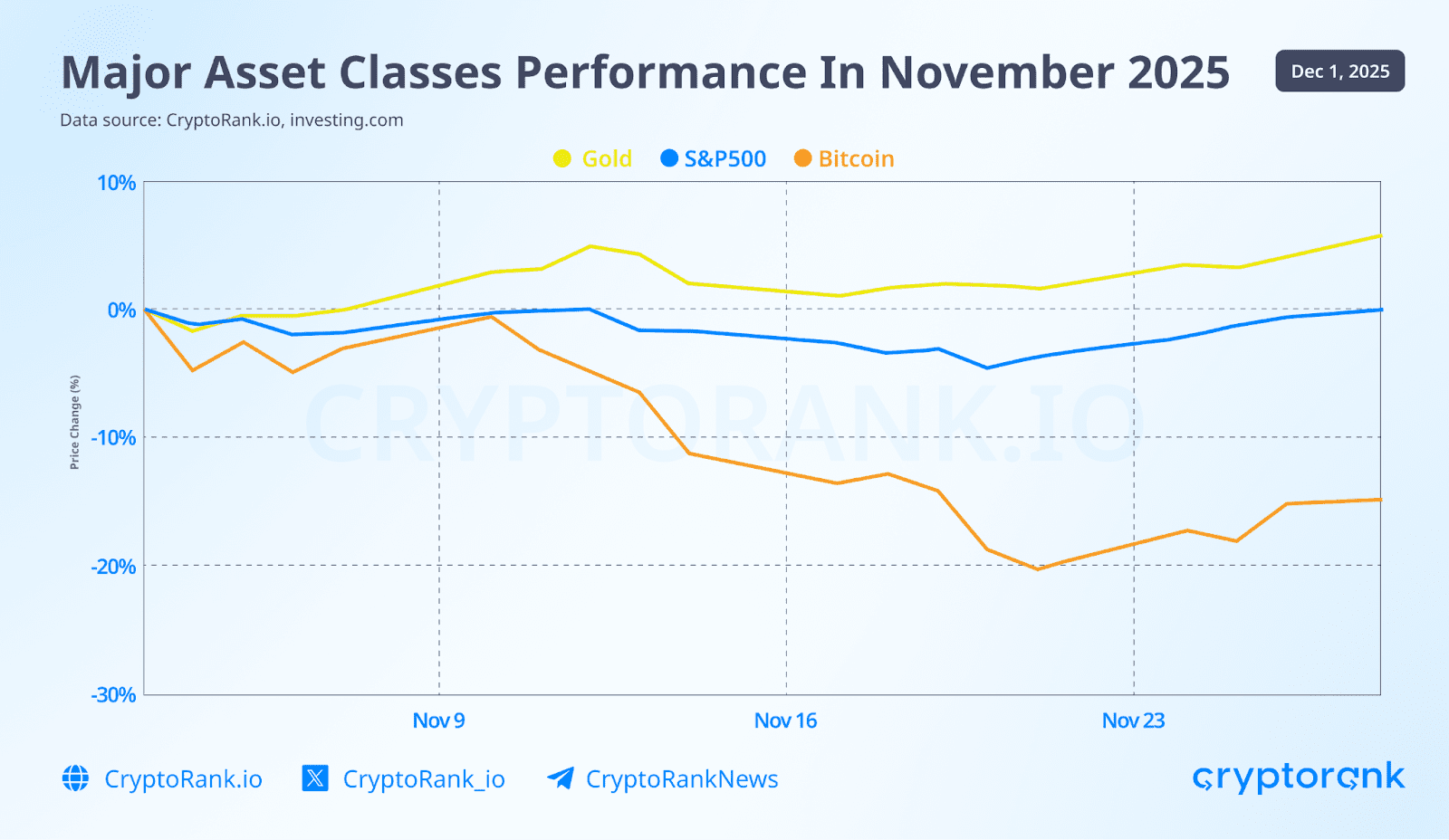

Market Reactions and Future Outlook

The crypto market has historically been sensitive to macroeconomic indicators, and the recent turmoil is no exception. As the shutdown drags on, Bitcoin and other major cryptocurrencies have experienced increased volatility, with price movements reflecting broader market apprehension. Investors are likely to adopt a more cautious approach, steering clear of riskier assets until there is clarity on governmental fiscal policies and economic stability.

Moreover, the potential for a protracted shutdown raises questions about regulatory progress in the crypto space. With the government at a standstill, initiatives aimed at establishing clearer frameworks for digital assets may stall, leaving investors in a state of uncertainty. This environment could discourage new investments in the sector as stakeholders await political resolution before committing capital.

Looking ahead, the resolution of the shutdown could pave the way for a market rebound, provided that investor confidence is restored. However, should the deadlock persist, we may see a significant shift in investor sentiment leading to further liquidations and a prolonged bear market. Investors should remain vigilant and prepared for continued fluctuations as the political climate evolves.