🔥 Key Takeaways

Understanding the Surge in Altcoin ETFs

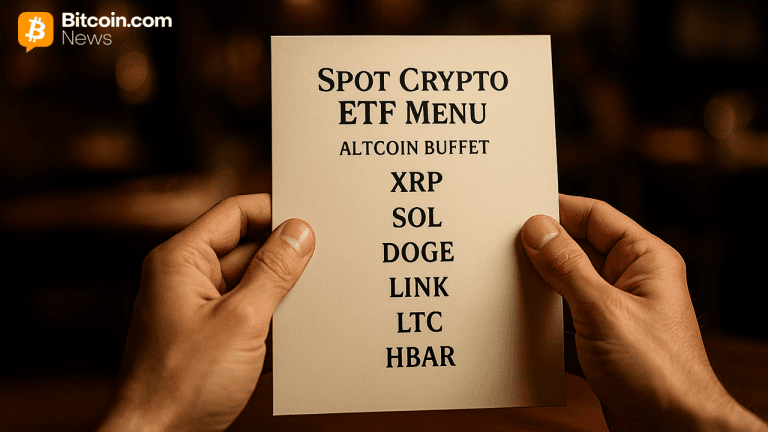

The recent surge in interest and investment into Exchange-Traded Funds (ETFs) tied to various altcoins has opened a new chapter in the crypto market. With the spotlight primarily on Solana (SOL) and its impressive $682 million in cumulative net inflows, it is noteworthy that XRP ETFs have quietly outpaced them, accumulating a staggering $874 million. This serves as a clear indication that institutional investors are increasingly looking beyond Bitcoin and Ethereum, establishing a diverse portfolio across various altcoins.

ETF Dynamics: A New Investment Landscape

The emergence of ETFs linked to cryptocurrencies such as Litecoin (LTC), Hedera (HBAR), Dogecoin (DOGE), and Chainlink (LINK) reflects a broader trend towards the acceptance of digital assets. These products not only enable easier access for retail and institutional investors alike but also provide a more structured investment avenue, mitigating some of the inherent volatility associated with direct cryptocurrency trading.

Why It Matters

The burgeoning interest in altcoin ETFs signals a critical evolution within the crypto ecosystem. As these financial instruments gain traction, they pave the way for increased regulatory clarity and mainstream acceptance. This shift is crucial for the long-term sustainability of the market, as ETFs can facilitate greater capital inflow while enhancing price stability. Furthermore, a diversified ETF landscape can help investors hedge their positions better, potentially reducing the risk associated with holding individual assets.

The Future of Altcoin Investment

As the crypto market matures, the introduction of altcoin ETFs is likely to encourage more investors to engage with a broader spectrum of digital assets. With major players in the market already showcasing significant inflows, it raises questions about the potential for future capital allocation. The current scenario exemplifies a shift towards a more complex and calculated approach to cryptocurrency investment, offering a glimpse into a future where digital assets occupy a more prominent role in diversified investment portfolios.

Going forward, the market will be closely watching how these altcoin ETFs perform, not only in terms of inflows but also their impact on the underlying assets’ prices and market dynamics. As institutional interest grows, the potential for altcoin ETFs to shape the landscape of cryptocurrency investment has never been more evident.