🔥 Key Takeaways

The ‘Why It Matters’ Section

The recent surge in inflows to Bitcoin exchange-traded funds (ETFs) comes at a pivotal moment for the cryptocurrency market. As Bitcoin’s price approaches the psychologically significant threshold of $93K, this trend not only reflects a rebound from a challenging November, characterized by substantial outflows, but also signals an increasing institutional appetite for exposure to digital assets. The favorable market conditions could play a crucial role in shaping the future landscape of cryptocurrency investments, potentially stabilizing prices and fostering greater legitimacy within the financial ecosystem.

Market Recovery and Institutional Sentiment

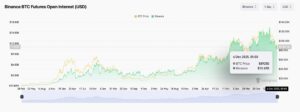

After suffering through a disheartening phase marked by over $3.48 billion in outflows during November—its second-worst month on record—Bitcoin ETFs have now recorded five consecutive days of inflows. Analysts are keen to emphasize that recent outflows may have been overstated, as broader market forces primarily fueled the sell-off rather than a lack of interest in Bitcoin itself.

The resurgence in inflows coincides with a notable price recovery for Bitcoin, underscoring an emerging optimism among investors. As BTC nears the $93K mark, it is essential to recognize the changing dynamics in investor sentiment. The involvement of institutional players, particularly in light of Vanguard’s recent decision to reverse its stance on crypto ETFs, suggests a strengthening of institutional demand that could further bolster the market.

Implications for the Future

As we look ahead, the trajectory of Bitcoin ETFs and overall cryptocurrency valuations will depend significantly on a couple of factors. First, sustained institutional interest is vital for market stability and growth. The inflow of capital into ETFs reflects not just speculative buying but a more strategic approach to investing in digital assets. Additionally, the regulatory environment and broader economic conditions will play critical roles in shaping the sentiment surrounding Bitcoin.

Furthermore, the recent ETF inflow trend indicates that a shift in investor psychology is underway. With institutional investors starting to view Bitcoin as a serious asset class, it could pave the way for enhanced adoption across traditional financial avenues. A sustained breach above the $93K mark might further catalyze interest, leading to an upward momentum in prices and the potential for new institutional entrants into the market.

In conclusion, as Bitcoin approaches new heights, the recovery of ETFs represents more than just a financial rebound; it signifies a potential paradigm shift in the acceptance and integration of cryptocurrencies within mainstream financial markets. The combination of institutional participation and price momentum presents a compelling case for a bullish outlook in the near term.