🔥 Key Takeaways

- Weaker income growth projected for Americans in 2026 could significantly impact crypto investment.

- Increased job insecurity adds another layer of downward pressure on disposable income available for speculative assets.

- Altcoins are likely to be more vulnerable than Bitcoin due to their higher risk profile.

- Economic headwinds could lead to a flight to safety, favoring established cryptocurrencies.

- Investors should carefully assess their risk tolerance and diversify their portfolios amid potential economic uncertainty.

American Crypto Investment: A Potential Downturn in 2026?

The cryptocurrency market has seen significant growth in recent years, with American investors playing a crucial role in its expansion. However, recent analysis suggests that this trend may face a significant challenge in 2026. Projected weaker income growth and a potential rise in job insecurity could leave Americans with less disposable income, directly impacting their ability to invest in cryptocurrencies.

The Economic Headwinds Facing American Investors

Several economic indicators point towards a potential slowdown in income growth. Inflation, while moderating, continues to erode purchasing power. Furthermore, concerns about potential economic recessions and subsequent job losses are creating a climate of uncertainty. This combination of factors could leave many Americans with little or no surplus income to allocate to speculative investments like cryptocurrencies.

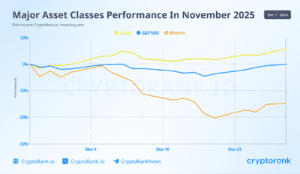

Altcoins at Greater Risk Than Bitcoin

Within the crypto market, altcoins, which are cryptocurrencies other than Bitcoin, are likely to be more vulnerable. Bitcoin, as the first and most established cryptocurrency, often benefits from a “flight to safety” during times of economic uncertainty. Its established infrastructure and broader acceptance make it a comparatively safer haven. Altcoins, on the other hand, typically carry a higher risk profile due to their smaller market capitalizations, greater price volatility, and potential for project failures. When disposable income shrinks, investors are more likely to prioritize essential expenses and less likely to take risks on unproven altcoins.

Implications for the Crypto Market

A decrease in American investment could have significant implications for the overall crypto market. While global adoption is increasing, the United States remains a major player. Reduced investment volume could lead to lower prices, increased volatility, and a slower pace of innovation. Projects reliant on American capital may struggle to secure funding, potentially hindering their development and long-term viability.

Recommendations for Investors

Given the potential economic headwinds, investors should carefully assess their risk tolerance and adjust their investment strategies accordingly. Diversification remains key. Allocating a smaller portion of your portfolio to cryptocurrencies, especially altcoins, can help mitigate potential losses. Additionally, focusing on projects with strong fundamentals, proven track records, and clear use cases can increase the likelihood of long-term success. Finally, staying informed about macroeconomic trends and their potential impact on the crypto market is crucial for making informed investment decisions.