🔥 Key Takeaways

- Bank of Canada only approves fiat-backed, high-quality stablecoins.

- These stablecoins must meet the criteria of “good money.”

- This move is part of Canada’s broader plan to modernize its financial system.

- Focus on stability and trust of these stablecoins.

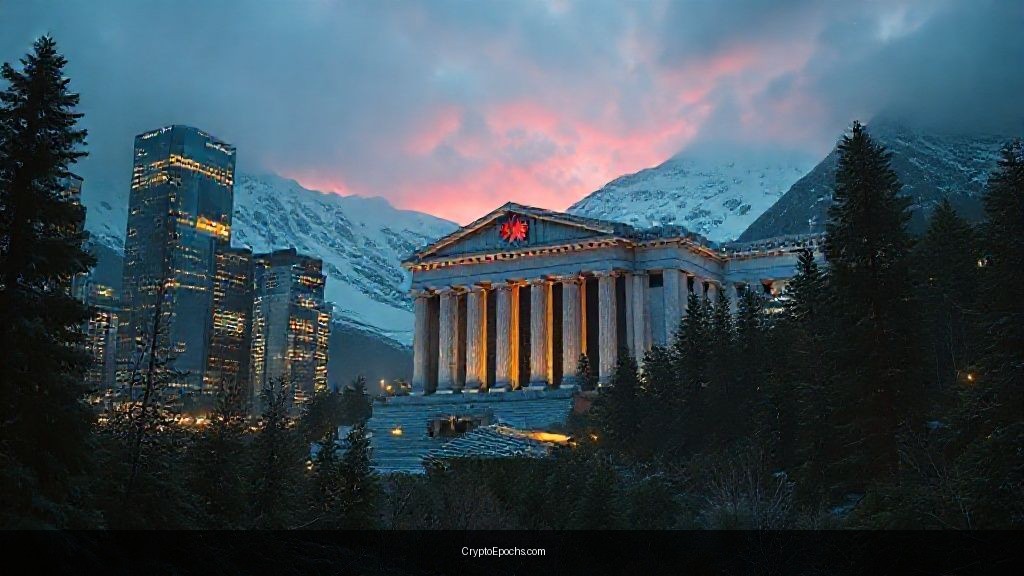

Bank of Canada Sets the Bar High for Stablecoins: What it Means for the Crypto Landscape

The Bank of Canada has made a significant statement regarding the future of stablecoins within the Canadian financial ecosystem. By explicitly stating that only fiat-backed, high-quality stablecoins will be approved, the central bank is signaling a commitment to ensuring the stability and trustworthiness of these digital assets. This isn’t just about allowing stablecoins to exist; it’s about crafting a framework where they can genuinely function as “good money” – reliable, widely accepted, and secure.

The “Good Money” Mandate: Implications for Stablecoin Issuers

The criteria for “good money,” as implied by the Bank of Canada’s statement, likely encompass stringent requirements for reserves, auditing, and regulatory oversight. Stablecoin issuers operating, or planning to operate, in Canada will need to prioritize transparency and compliance. This means maintaining 1:1 backing with high-quality, liquid assets (likely Canadian dollars) and undergoing regular, independent audits to verify reserves. The emphasis on quality suggests that uninsured, algorithmic stablecoins are unlikely to gain regulatory approval under this framework.

A Step Towards Modernization: But at What Cost?

While this move undoubtedly contributes to the modernization of Canada’s financial system, it also raises questions about innovation and competition. The high bar set by the Bank of Canada could potentially stifle the development of alternative stablecoin models, potentially favoring established players with the resources to meet the stringent requirements. Smaller, more innovative projects might find it challenging to compete in this landscape. However, the focus on stability and consumer protection is paramount, especially considering the volatility often associated with the broader cryptocurrency market.

What This Means for the Future of Crypto in Canada

This decision by the Bank of Canada is a clear indication of a measured and deliberate approach to integrating digital assets into the existing financial infrastructure. It suggests a preference for regulated, centralized stablecoin models over decentralized, more volatile alternatives. While this may disappoint some proponents of decentralized finance (DeFi), it provides a pathway for mainstream adoption by building trust and confidence in the stability of these digital currencies. Ultimately, the success of this approach will depend on the effectiveness of the regulatory framework in fostering both innovation and consumer protection.