🔥 Key Takeaways

Bitcoin Under Scrutiny: Insights from a Former Executive

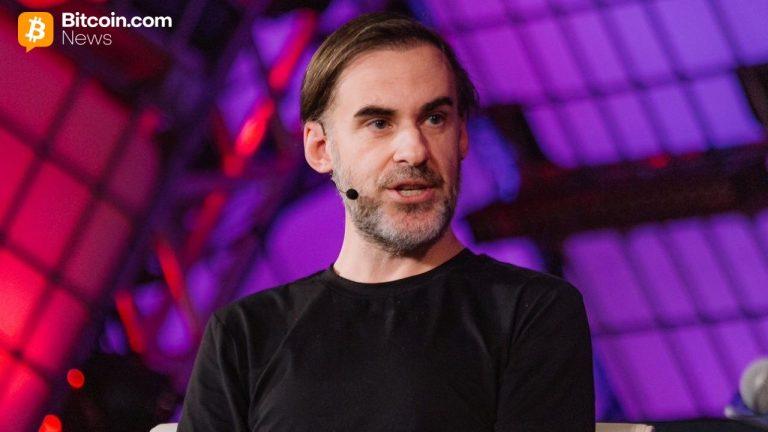

In a striking turn of events, Mike Brock, a former executive at Block, has publicly declared that “Bitcoin will fail. Because it is a lie.” His remarks, made in the context of a reawakening cryptocurrency market, raise significant questions about Bitcoin’s long-term sustainability and the very principles upon which it was founded. Brock’s criticisms come at a time when Bitcoin is experiencing a resurgence in interest and price momentum, making his statements all the more provocative.

Understanding the Context

Brock’s comments are not merely the ramblings of a disgruntled ex-employee; they reflect a broader trend of skepticism among some former proponents of cryptocurrency. His position at Block, which has been a notable player in the Bitcoin ecosystem, lends weight to his assertions. By labeling Bitcoin a “lie,” Brock seems to challenge the core tenets of decentralization and trustlessness that underpin the cryptocurrency narrative.

Moreover, the timing of these comments is critical. As Bitcoin continues to attract institutional interest and retail investment, the crypto community must grapple with such dissenting voices. The skepticism voiced by Brock may resonate with those who have witnessed the volatility and regulatory hurdles that have plagued Bitcoin, as well as the broader cryptocurrency market.

Why It Matters

Brock’s alarm signals a potential shift in sentiment that could influence both market dynamics and regulatory approaches. His assertion that Bitcoin could fail might deter new investors and raise eyebrows among regulators who are already wary of the cryptocurrency’s implications for financial stability. If more industry leaders begin to echo Brock’s sentiments, we could see a ripple effect leading to increased scrutiny and possibly harsher regulations aimed at safeguarding investors and the financial system.

The impact of such critiques also extends to the narrative surrounding Bitcoin as a “digital gold” or a hedge against inflation. If influential figures continue to challenge Bitcoin’s legitimacy, it may shift public perception and lead to a reevaluation of its role in both personal investment strategies and broader financial markets.

Looking Ahead

As the cryptocurrency landscape evolves, the industry must remain vigilant in addressing criticisms such as those posed by Brock. Understanding the underlying reasons for skepticism and engaging in constructive dialogue about Bitcoin’s future will be crucial for its longevity. Investors and stakeholders should consider both the bullish potential of Bitcoin as well as the validity of critiques that could shape its future trajectory.

In summary, while Bitcoin’s current performance may appear promising, the challenges highlighted by industry veterans serve as important reminders of the cryptocurrency’s uncertain path forward. Stakeholders should remain informed and engaged as the discourse around Bitcoin continues to unfold, particularly in light of regulatory developments and market reactions.