🔥 Key Takeaways

- Retail participation in the cryptocurrency market has declined throughout the current cycle.

- Historically, a decline in retail interest has been seen as a signal for a market bottom.

- However, the current downturn may reflect a deeper cultural and social shift, rather than a traditional market cycle.

Retail Interest in Cryptocurrency: A Changing Landscape

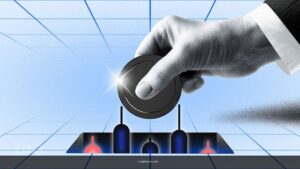

The cryptocurrency market has experienced a significant decline in retail participation throughout the current cycle. As the year draws to a close, interest in cryptocurrency among individual investors continues to weaken. While some analysts interpret this decline as a classic signal for a market bottom, others argue that the current downturn reflects a more profound cultural and social shift.

The Traditional View: Declining Retail Interest as a Buy Signal

Historically, a decline in retail interest has been seen as a buy signal in the cryptocurrency market. The idea behind this view is that when individual investors lose interest in cryptocurrency, it creates an opportunity for institutional investors to buy in at lower prices. This, in turn, can lead to a reversal in the market trend and an increase in prices.

A New Era: Cultural and Social Shifts in Investor Attention

However, the current downturn may reflect a deeper cultural and social shift, rather than a traditional market cycle. The decline in retail interest in cryptocurrency may be a sign that investor attention has moved away from the asset class, rather than a temporary loss of interest. This shift could be driven by a variety of factors, including increased competition from other investment opportunities, regulatory uncertainty, and a decline in the perceived value of cryptocurrency.

Implications for Investors

The implications of this shift are significant for investors. If the decline in retail interest in cryptocurrency is a sign of a deeper cultural and social shift, rather than a traditional market cycle, it may not be a reliable indicator of a market bottom. Investors who rely on this indicator to make investment decisions may find themselves caught off guard by a prolonged decline in prices.

Conclusion

The decline in retail participation in the cryptocurrency market is a complex phenomenon that may not be fully explained by traditional market analysis. While some analysts may interpret this decline as a buy signal, others argue that it reflects a deeper cultural and social shift in investor attention. As the market continues to evolve, it’s essential for investors to consider a wide range of factors and to be cautious of relying on traditional indicators to make investment decisions.