# L1 Tokens Crushed in 2025: SOL, AVAX Plummet Over 65% Amid Market Turmoil

🔥 Key Takeaways

- Solana (SOL) fell 35.9%, while Avalanche (AVAX) dropped over 67% in 2025.

- Markets punished L1 tokens lacking sustainable revenue streams, despite strong developer activity.

- The downturn highlights investor skepticism toward long-term viability without clear monetization.

- Other major L1 blockchains, including Ethereum competitors, also faced steep declines.

## Market Meltdown: L1 Tokens Under Pressure

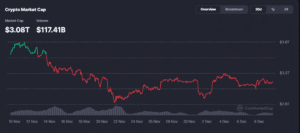

The crypto market witnessed a brutal correction in 2025, with Layer 1 (L1) blockchain tokens bearing the brunt of the sell-off. Leading ecosystems like Solana (SOL) and Avalanche (AVAX) saw their valuations collapse, with SOL dropping 35.9% and AVAX plummeting over 67%—far underperforming Bitcoin and Ethereum.

This downturn reflects growing investor concerns over unsustainable tokenomics and lack of revenue generation, despite many L1 chains boasting high developer activity and ecosystem growth.

## Why Did L1 Tokens Crash?

### 1. Revenue Models Under Scrutiny

Many L1 blockchains rely heavily on speculative demand rather than real economic activity. While networks like Solana and Avalanche have seen strong adoption in DeFi and NFTs, their native tokens often lack clear utility beyond gas fees and staking rewards.

### 2. Competition from Ethereum & L2s

Ethereum’s dominance in smart contracts and DeFi remained unchallenged, while Layer 2 solutions (L2s) like Arbitrum and Optimism captured market share with lower fees and higher scalability. This left many L1s struggling to justify their valuations.

### 3. Macroeconomic Pressures

The broader crypto market faced headwinds from rising interest rates and regulatory uncertainty, leading investors to favor assets with proven cash flows (like Bitcoin and Ethereum) over speculative altcoins.

## What’s Next for L1 Blockchains?

The 2025 crash serves as a wake-up call for L1 projects to:

– Develop stronger revenue models (e.g., protocol-owned liquidity, sustainable fee structures).

– Enhance real-world utility beyond speculative trading.

– Improve interoperability to compete with Ethereum’s ecosystem.

While some L1s may recover, others could face consolidation or obsolescence if they fail to adapt.

—