Key Takeaways

- Senator Elizabeth Warren is seeking information from the DOJ and Treasury on potential investigations into DeFi exchanges.

- The inquiry aims to determine if these exchanges are complying with anti-money laundering and know-your-customer regulations.

- The probe could have significant implications for the DeFi industry, potentially leading to increased regulatory oversight.

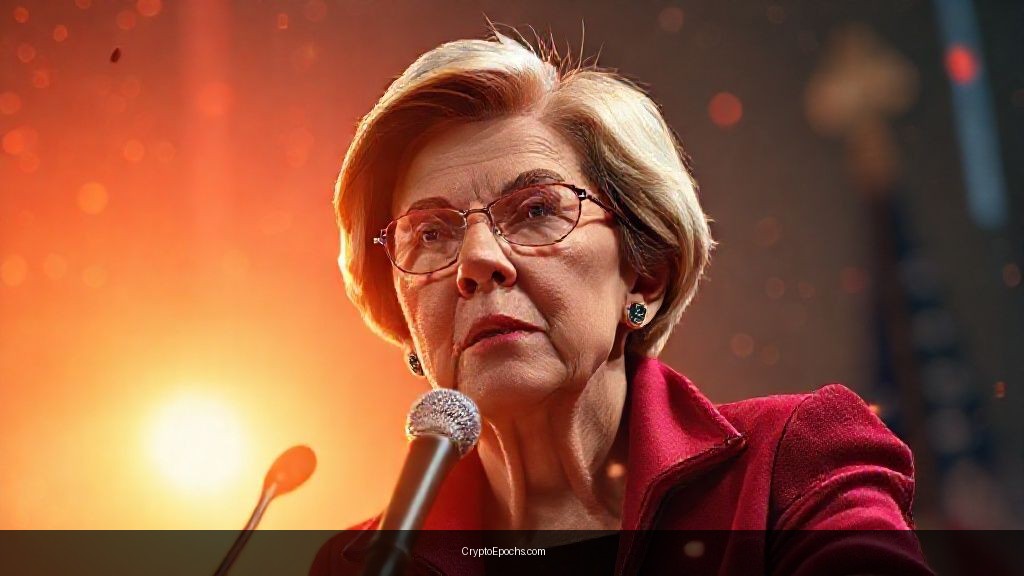

Elizabeth Warren Presses for Answers on DeFi Exchanges

Senator Elizabeth Warren has recently pressed the Department of Justice (DOJ) and the Treasury Department to provide information on whether decentralized finance (DeFi) exchanges are under active investigation. This move comes as part of a broader effort to ensure that these exchanges are complying with existing financial regulations, particularly those related to anti-money laundering (AML) and know-your-customer (KYC) requirements.

Implications for the DeFi Industry

The potential probe into DeFi exchanges could have significant implications for the industry as a whole. If the DOJ and Treasury Department find that these exchanges are not in compliance with regulatory requirements, it could lead to increased oversight and potentially even enforcement actions. This, in turn, could impact the way DeFi exchanges operate, potentially leading to increased costs and complexity for these platforms.

Regulatory Environment

The regulatory environment for DeFi exchanges is still evolving, and there is ongoing debate about how these platforms should be regulated. While some argue that DeFi exchanges should be subject to the same regulations as traditional financial institutions, others believe that a more nuanced approach is needed, taking into account the unique characteristics of these platforms. Senator Warren’s inquiry is likely to add to this debate, and could potentially shape the future of DeFi regulation in the United States.