🔥 Key Takeaways

Understanding the Yearn Finance Exploit: A Deep Dive

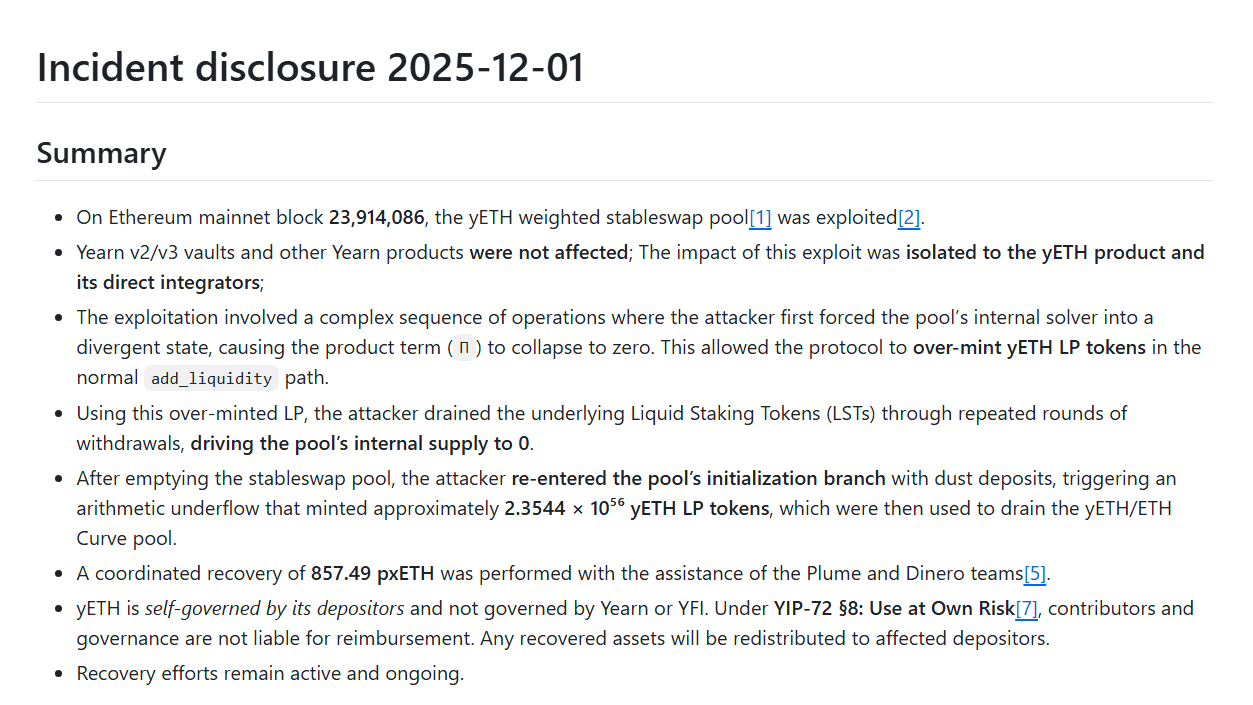

The recent exploit of Yearn Finance has raised significant concerns across the decentralized finance (DeFi) landscape. The incident stemmed from a numerical flaw in one of Yearn’s older stableswap pools, which enabled the perpetrator to mint an almost unlimited number of liquidity provider (LP) tokens. This exploit resulted in a theft of approximately $9 million, highlighting vulnerabilities that can arise even in established platforms.

Yearn Finance, known for its innovative yield farming strategies and automated investment strategies, has been a leading player in the DeFi space. However, this incident serves as a stark reminder that even the most trusted protocols are not immune to flaws. The detailed post-mortem released by Yearn is not just an account of what transpired but also a crucial step towards transparency and accountability in the DeFi ecosystem.

Why It Matters

The Yearn Finance exploit carries significant implications for the broader DeFi sector. First and foremost, it underscores the critical importance of security audits and the need for continuous monitoring of smart contracts. As DeFi platforms proliferate, the risk of exploits increases, making it essential for developers to prioritize rigorous testing and validation processes.

Moreover, the recovery of some stolen funds by Yearn Finance is a positive development, but it also raises questions about the robustness of DeFi’s current security measures. Users must be made aware of the potential risks involved when interacting with these platforms. The exploit not only affects Yearn’s reputation but also has a ripple effect, potentially eroding trust in DeFi protocols as a whole.

As the DeFi space evolves, it is imperative for projects to incorporate best practices for security and risk management. This incident may catalyze a wave of improvements and innovations in security protocols, encouraging developers to adopt more stringent measures to safeguard against similar vulnerabilities.

In light of this event, stakeholders within the DeFi community are urged to reassess their security strategies and consider collaborative approaches to enhance the overall resilience of the ecosystem. The collective responsibility towards security can help mitigate future risks and foster a safer environment for all participants.

For further information on the implications of this exploit, you can refer to resources from [CoinDesk](https://www.coindesk.com/) and [The Block](https://www.theblock.co/).