🔥 Key Takeaways

- Hyperliquid has confirmed that a wallet accused of shorting $HYPE is linked to a former employee fired in Q1 2024.

- The incident raises questions about insider trading and the integrity of crypto markets.

- $HYPE’s price volatility highlights the risks associated with decentralized finance (DeFi) platforms.

Hyperliquid Confirms $HYPE Shorting Address Linked to Ex-Employee

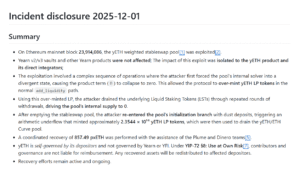

Hyperliquid, a prominent decentralized finance (DeFi) platform, has confirmed that a wallet accused of shorting its native token $HYPE belongs to a former employee who was terminated in the first quarter of 2024. This revelation has sparked concerns about insider trading and the integrity of cryptocurrency markets.

The wallet in question was identified by community members who noticed unusual trading activity aimed at driving down the price of $HYPE. Hyperliquid swiftly investigated the matter and traced the wallet to the ex-employee, who allegedly leveraged their insider knowledge to manipulate the token’s price. While Hyperliquid has not disclosed the details of the employee’s actions or their motives, the incident underscores the challenges DeFi platforms face in maintaining transparency and security.

The $HYPE token experienced significant volatility following the shorting activity, causing unease among investors. This episode highlights the risks associated with decentralized trading platforms, where malicious actors can exploit vulnerabilities for personal gain. Hyperliquid has assured its users that it is implementing stricter internal controls to prevent similar incidents in the future.

As the crypto industry continues to evolve, this incident serves as a reminder of the importance of robust governance and oversight in decentralized ecosystems. Investors are encouraged to conduct thorough due diligence and remain vigilant against potential market manipulation.