🔥 Key Takeaways

- Crypto bridges are crucial for blockchain interoperability, enabling asset and data transfer across different networks.

- They address the challenge of siloed blockchains, enhancing the overall utility and efficiency of the crypto ecosystem.

- Understanding the mechanisms and risks of cross-chain bridges is vital for navigating the evolving landscape of decentralized finance (DeFi).

The Need for Interoperability

One of the most significant hurdles in the crypto space has been the lack of seamless communication and interaction between different blockchains. Each blockchain, with its own set of rules and protocols, often operates in isolation. This creates siloed ecosystems, limiting the potential for cross-chain collaboration and innovation. The rise of numerous blockchains, each tailored for specific applications, has further exacerbated this issue. The need for a solution that enables these disparate networks to communicate and transact with each other has become increasingly apparent.

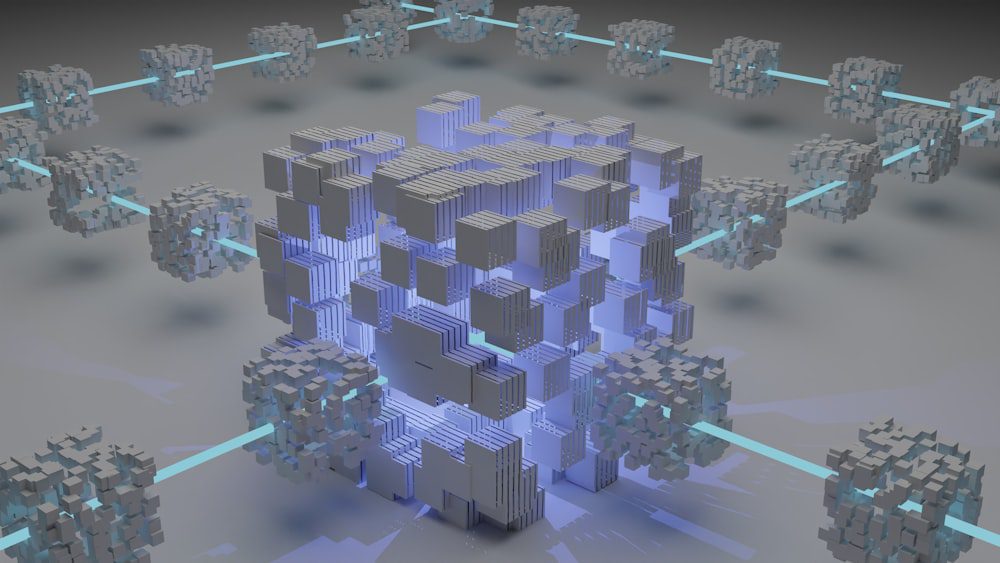

What are Crypto Bridges?

Crypto bridges, also known as blockchain bridges or cross-chain bridges, are technologies that facilitate the transfer of assets and data between different blockchains. They act as conduits, allowing users to move their cryptocurrencies and other digital assets from one blockchain to another. By enabling interoperability, these bridges unlock new possibilities for DeFi applications, cross-chain governance, and the seamless movement of value across the crypto ecosystem.

How do Bridges Work?

While the specific implementation details can vary widely, most crypto bridges operate on similar principles. Typically, when a user wants to transfer an asset from Blockchain A to Blockchain B, the asset is locked or “burned” on the original chain (Blockchain A). The bridge then creates a corresponding representation of the asset on the destination chain (Blockchain B), such as a wrapped token. This allows the user to utilize the asset within the ecosystem of Blockchain B. When the user wants to redeem the original asset, the wrapped token is “burned” on Blockchain B, and the original asset is unlocked on Blockchain A. Different bridging mechanisms include trusted, trustless, and hybrid approaches, each with its own trade-offs in terms of security, speed, and cost.

The Future of Blockchain Interoperability

Crypto bridges are playing a crucial role in shaping the future of blockchain interoperability. As the crypto space continues to mature, the demand for seamless cross-chain interactions will only increase. While bridges offer a promising solution, it’s important to note that they come with certain risks, including security vulnerabilities and potential for smart contract exploits. Ongoing development and research are focused on creating more secure and efficient bridging solutions that can foster a more interconnected and collaborative crypto ecosystem. The evolution of crypto bridges will be essential for realizing the full potential of a multi-chain future.