🔥 Key Takeaways

- Crypto bots are increasingly popular for capitalizing on market volatility.

- Understanding the mechanics of ‘buy the dip’ strategies can enhance investment returns.

- As the crypto market matures, leveraging technology for trading becomes essential.

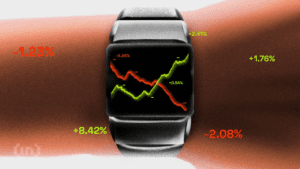

The Rise of Crypto Trading Bots in Volatile Markets

The cryptocurrency market is notorious for its price volatility, and as we’ve seen in recent years, flash crashes can occur with little warning, presenting both risks and opportunities for traders. In this landscape, the emergence of crypto trading bots specifically designed for ‘buy the dip’ strategies has gained significant traction. According to a recent analysis by CoinSutra, these bots are essential tools for traders aiming to capitalize on sudden price dips in cryptocurrencies.

Why It Matters

The importance of trading bots in the crypto space cannot be overstated. In times of market turmoil, where human emotions often lead to panic selling, bots operate based on algorithms and predefined strategies. This objectivity can be crucial for maximizing returns during flash crashes. Moreover, as the crypto ecosystem evolves, the sophistication of these bots is improving, integrating advanced analytics and machine learning to predict price movements more accurately.

Key Features of Effective Crypto Bots

When choosing a bot for trading during market dips, several features become critical:

- Automation: The ability to execute trades without human intervention allows for quicker responses to market changes.

- Customizability: Users should be able to tailor bot settings according to their trading strategies and risk tolerance.

- Backtesting: A bot that allows for backtesting with historical data can provide insights into its potential performance.

- Integration: The best bots will seamlessly integrate with multiple exchanges, giving users access to a broader market.

Looking Ahead: The Future of Trading Bots

As we advance into 2025, the integration of artificial intelligence and machine learning into trading bots is expected to enhance their efficiency and accuracy. With the growing complexity of the crypto market, traders who leverage these technologies will likely find themselves at a competitive advantage. Additionally, regulatory developments may further shape the landscape, making it imperative for bot developers to adapt and innovate continuously.

For anyone considering the use of crypto bots, it is essential to conduct thorough research and remain informed about market trends. Resources such as CoinDesk and The Block provide valuable insights into the dynamics of the crypto market, ensuring that traders are well-equipped to make informed decisions.