🔥 Key Takeaways

Understanding the AfterDark ETF’s Strategic Advantage

The cryptocurrency market has long been characterized by its volatility and the influence of time zones on trading strategies. Historically, traders have navigated various global markets, with different regions exhibiting distinct trading patterns and optimal times for executing trades. The newly proposed Nicholas Bitcoin and Treasuries AfterDark ETF seeks to capitalize on this dynamic by offering exposure to Bitcoin in a manner that intentionally counters the trading behaviors of American investors.

The Rationale Behind Time Zone Arbitrage

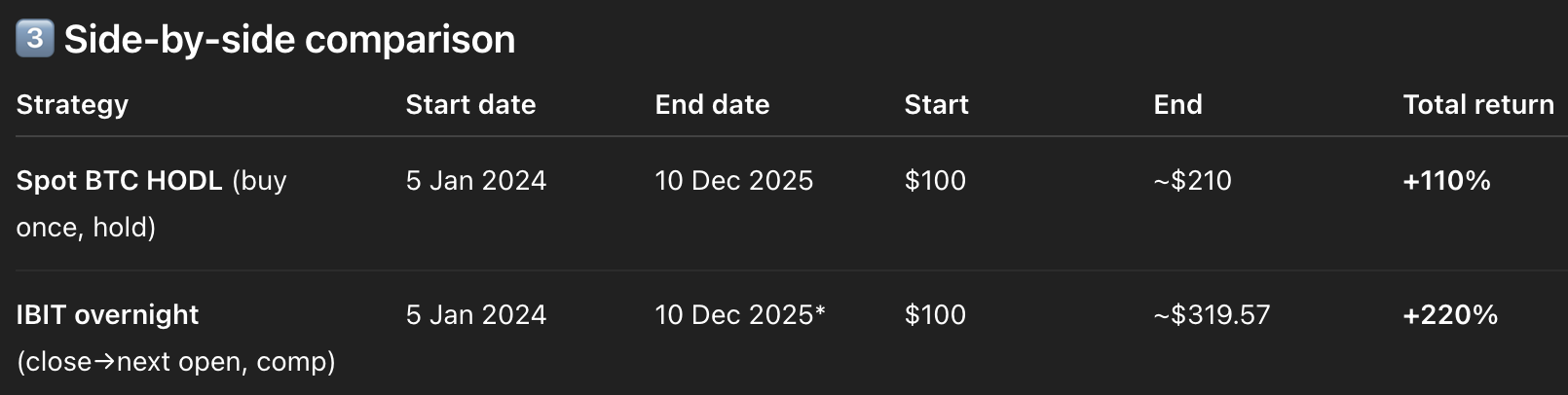

As U.S. traders frequently dominate market sentiment during their active trading hours, the AfterDark ETF proposes a strategy that focuses on trading during the off-hours of the American market. This counter-trading approach aims to exploit price discrepancies that arise when U.S. markets are closed, capitalizing on the activity of European and Asian traders who may have different market perspectives and strategies. The concept hinges on the idea that when American traders are inactive, there is an opportunity to unlock substantial returns—potentially as high as 222%.

Why It Matters

The introduction of the AfterDark ETF could significantly reshape how institutional investors view Bitcoin. By providing a structured financial vehicle that addresses the inherent challenges of trading across time zones, this ETF not only offers a solution to a long-standing issue but also enhances the attractiveness of Bitcoin as a viable investment option. Furthermore, it underscores the importance of innovative financial products in increasing market liquidity and efficiency. Such developments may encourage more institutional participation in the cryptocurrency space, potentially leading to increased price stability and reduced volatility.

Conclusion: A New Dawn for Bitcoin Trading?

The AfterDark ETF represents a fascinating evolution in the cryptocurrency investment landscape. By focusing on counter-trading strategies that leverage global market behaviors, it could unlock previously inaccessible returns for investors. As the cryptocurrency market continues to mature, products like the AfterDark ETF highlight the ongoing quest for optimal trading strategies in an ever-evolving financial environment. For investors looking to navigate the complexities of Bitcoin trading, this ETF could serve as a pioneering model for future investment opportunities.