🔥 Key Takeaways

- Bitcoin’s surge to $91,767 resulted in substantial liquidations for short positions.

- Heavy institutional buying signals renewed confidence among market participants.

- This rebound indicates potential bullish momentum as traders reassess market sentiment.

Understanding the Market Dynamics of Bitcoin’s Rebound

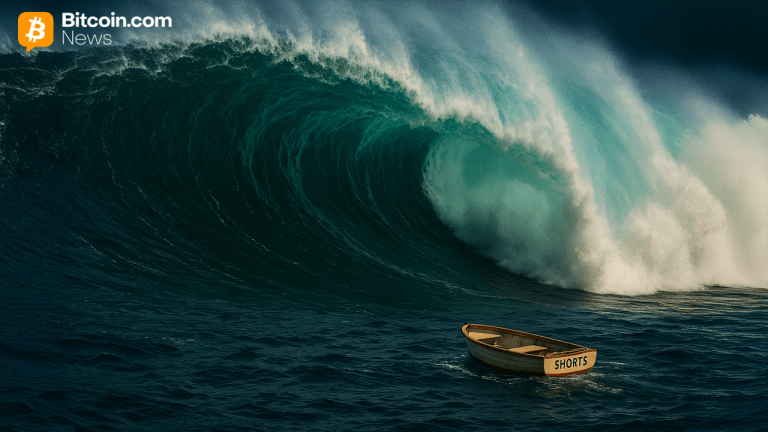

In a surprising twist this weekend, Bitcoin managed to rebound sharply from its earlier struggles below $88,000, soaring to an intraday high of $91,767. This movement not only reversed the fortunes for many weekend traders but also instigated a significant liquidation wave across the crypto market, primarily affecting short positions. Such a rapid shift in price dynamics is indicative of a larger trend at play, highlighting the role of heavy buyers in the current market environment.

The Role of Liquidations in Market Movements

The massive liquidation event that accompanied Bitcoin’s price spike is a critical aspect to analyze. When Bitcoin surged, it forced many traders who were betting against the asset to close their positions at a loss, often leading to a cascade of further selling pressure. As short positions were liquidated, the ensuing demand from the market helped to propel Bitcoin’s price even higher. This phenomenon demonstrates the fragility of market structures reliant on high leverage, particularly in a volatile environment.

Heavy Buyers Signal Renewed Confidence

The re-emergence of deep-pocketed buyers during this rebound is noteworthy. Such investors often possess the capacity to influence market trends significantly. Their activity not only indicates a potential bullish sentiment but also suggests that institutional interest remains robust. As major players step back into the fray, it reinforces the narrative that Bitcoin could be moving into a new bullish phase. The current market conditions may be prompting institutions to reassess their strategies, seeking to capitalize on perceived undervaluation.

Why It Matters

This rebound and the accompanying liquidation wave are crucial for several reasons. Firstly, it highlights the inherent volatility and risk present in the cryptocurrency markets, particularly for those using high leverage. Secondly, the resurgence of institutional buyers could signal a shift in market sentiment towards a more bullish outlook, potentially attracting more retail investors. Lastly, these developments may lead to increased scrutiny from regulators as the market matures and evolves. Understanding these dynamics is essential for investors looking to navigate the rapidly changing landscape of cryptocurrencies.

As we move forward, it will be essential to monitor how this price action impacts broader market trends and investor behavior. The interplay between buyer confidence and market volatility will undoubtedly shape the future trajectory of Bitcoin and the overall cryptocurrency market.