🔥 Key Takeaways

- Bitcoin has shown a significant decoupling from global M2 money supply growth since mid-2025, intensifying by early 2026.

- The historical correlation between Bitcoin and M2 had previously supported bullish predictions, but analysts are now divided on its implications.

- The decoupling raises questions about Bitcoin’s evolving role as a hedge against inflation and its relationship with macroeconomic indicators.

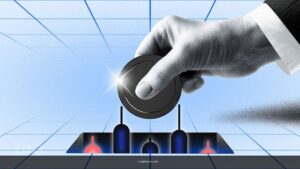

Bitcoin’s Decoupling From Global M2: A New Era in 2026

Since mid-2025, Bitcoin has increasingly exhibited signs of decoupling from the growth of the global M2 money supply, a phenomenon that has become even more pronounced by early 2026. This development marks a significant shift from previous years, where Bitcoin’s price movements were closely tied to macroeconomic factors, particularly the expansion of global liquidity. Historically, the correlation between Bitcoin and M2 served as a cornerstone for bullish forecasts, with many viewing Bitcoin as a hedge against inflation and currency devaluation. However, this decoupling has left analysts deeply divided over its implications for the future of Bitcoin.

What Does This Decoupling Mean?

The decoupling of Bitcoin from global M2 raises critical questions about its role in the financial ecosystem. Some analysts argue that this shift indicates Bitcoin’s maturation as an asset class, evolving beyond its initial narrative as a mere inflation hedge. They suggest that Bitcoin is increasingly influenced by factors such as institutional adoption, technological advancements, and regulatory developments, rather than macroeconomic trends alone.

On the other hand, skeptics caution that the decoupling may signal a loss of Bitcoin’s fundamental value proposition. They argue that Bitcoin’s appeal as a store of value is intrinsically linked to its ability to counteract the effects of monetary expansion. Without this correlation, Bitcoin’s long-term viability as a hedge against inflation could be called into question.

Analysts Remain Divided

The debate among analysts is further fueled by the lack of consensus on the underlying causes of this decoupling. Some attribute it to Bitcoin’s growing adoption in regions with stable monetary policies, reducing its sensitivity to global liquidity trends. Others point to the increasing influence of speculative trading and market sentiment, which may overshadow macroeconomic fundamentals.

Regardless of the cause, the decoupling of Bitcoin from global M2 represents a pivotal moment in its evolution. As the cryptocurrency market continues to mature, the relationship between Bitcoin and traditional financial indicators will likely remain a topic of intense scrutiny and debate.

Looking Ahead to 2026 and Beyond

As Bitcoin continues to decouple from global M2 in 2026, the implications for investors and the broader financial market remain uncertain. While some view this trend as a sign of Bitcoin’s growing independence and resilience, others see it as a potential red flag. Ultimately, the future of Bitcoin will depend on its ability to adapt to changing market dynamics and redefine its role in the global economy.