🔥 Key Takeaways

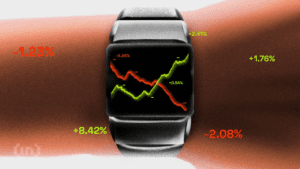

- Bitcoin faces resistance as buyers and sellers battle for market control.

- Traders are signaling caution despite potential recovery indicators.

- Market sentiment remains mixed, influenced by macroeconomic factors.

Understanding the Current Landscape of Bitcoin

Bitcoin’s recent price fluctuations have sparked debates among traders and analysts alike. Currently, the market appears to be in a precarious position, with buyers and sellers engaged in a tug-of-war. While there are some signs of recovery, traders are adopting a cautious stance, reflecting uncertainty about future movements.

Three Signals of Caution

Despite the anticipation of a potential recovery, three key signals reveal why traders remain on edge:

1. Market Resistance Levels: Bitcoin has encountered significant resistance around the $30,000 mark. This threshold has historically acted as a barrier, and the inability to break above this level suggests that sellers are still in control. A sustained push above this level would be necessary to instill confidence among traders.

2. Mixed Sentiment Indicators: Sentiment analysis shows a split among traders. While some are optimistic about Bitcoin’s long-term potential, the prevailing sentiment remains cautious. This mixed sentiment reflects broader concerns regarding regulatory developments and macro-economic factors that could influence Bitcoin’s trajectory.

3. Volume and Volatility Trends: Trading volumes have been lower than expected during recent price movements, indicating a lack of conviction among market participants. Additionally, the volatility has been relatively subdued, suggesting that traders are waiting for a clearer signal before committing capital.

Why It Matters

The cautious outlook among traders is significant for several reasons. First, it highlights the ongoing uncertainty in the cryptocurrency market, which is often influenced by external factors such as interest rates, inflation, and geopolitical events. A stable market typically sees increased trading volumes and higher confidence among investors, which in turn can lead to price appreciation.

Furthermore, the inability of Bitcoin to decisively break through resistance levels could signal to potential investors that the market is not yet ready for a bullish run. This caution could hinder institutional investment, which has been a pivotal driver of Bitcoin’s price dynamics in recent years. Ultimately, how Bitcoin navigates this critical juncture will be pivotal in shaping its market narrative moving forward.

In conclusion, while there are indications that Bitcoin could recover, the current market signals suggest that traders should remain vigilant and assess their strategies accordingly. The interplay between bullish sentiment and bearish resistance will continue to dictate Bitcoin’s price movements in the near term. For further reading on market dynamics, consider checking out CoinDesk or Reuters.