🔥 Key Takeaways

Bitcoin’s Price Conundrum: Options Market Dynamics at Play

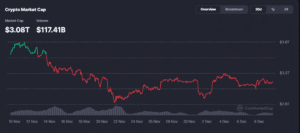

Bitcoin has spent a considerable amount of time oscillating between $85,000 and $90,000, leaving both bulls and bears frustrated and unsure of the next move. Contrary to what one might expect, the lack of momentum is not due to a lack of buying interest or unfavorable macroeconomic conditions. Instead, the culprit behind this price stagnation lies within the options market. Derivatives data reveals that dealer gamma exposure is currently suppressing spot price volatility through mechanical hedging, effectively keeping Bitcoin’s price range-bound.

Understanding Gamma Exposure and Its Impact

Gamma exposure refers to the rate of change of an option’s delta, which measures the option’s sensitivity to the underlying asset’s price. When dealers sell options, they are exposed to gamma risk, which can lead to mechanical hedging. This hedging activity involves buying or selling the underlying asset to offset the potential losses from the options sold. In the case of Bitcoin, dealers are currently hedging their options exposure by buying or selling the cryptocurrency, thereby reducing price volatility and keeping the price within the $85,000 to $90,000 range.

The $24 Billion Options Trap: A Potential Catalyst for a Breakout

A significant options trap, valued at $24 billion, is set to expire in just two days. This expiration event could potentially trigger a breakout from the current price range, as dealers adjust their hedges and market participants react to the changing options landscape. If the price breaks out above $90,000, it could lead to a surge in buying interest, while a breakdown below $85,000 could trigger a wave of selling. Either way, the expiration of this options trap is likely to bring much-needed volatility back to the Bitcoin market.