🔥 Key Takeaways

- Astria Network, a key player in the Celestia ecosystem, is shutting down despite a significant funding round in 2024.

- The closure casts a shadow over the long-term viability and resilience of projects building on Celestia’s modular blockchain architecture.

- TIA’s price faces potential headwinds as market sentiment turns cautious, prompting reassessments of the token’s valuation.

Celestia’s Ecosystem Under Scrutiny: Astria’s Demise and TIA’s Trajectory

The recent surge in the broader cryptocurrency market, exemplified by Bitcoin’s resurgence above $72,000, provides a stark contrast to the emerging challenges within the Celestia ecosystem. The impending shutdown of Astria Network, a project designed to provide shared sequencing for rollups on Celestia, raises critical questions about the sustainability and robustness of projects built on its modular blockchain architecture. Despite securing $18 million in funding last year, Astria’s closure injects uncertainty into the network’s future.

This development acts as a stress test for the Celestia thesis. The promise of modular blockchains lies in their flexibility and scalability, allowing developers to build customized solutions. However, the failure of a prominent project like Astria raises concerns about the inherent risks and dependencies within this nascent ecosystem. Investors are now compelled to re-evaluate the long-term prospects of TIA, the native token of Celestia, and its susceptibility to ecosystem-specific setbacks.

The ‘Why It Matters’ Section

The Astria situation is significant because it highlights the vulnerability of ecosystems reliant on a limited number of foundational projects. When a key component falters, the entire structure can be jeopardized. For Celestia, this event serves as a crucial learning opportunity. The community and development teams must prioritize diversification and resilience, fostering a more robust and interconnected network to mitigate future shocks. It also underscores the importance of thorough due diligence for investors considering projects within the Celestia ecosystem.

Furthermore, this situation underscores the inherent risks in early-stage crypto ventures. Substantial funding does not guarantee success, and market dynamics can shift rapidly. Investors must carefully assess not only the technical merits of a project but also its long-term viability and its ability to adapt to evolving market conditions. The Astria shutdown serves as a cautionary tale, emphasizing the need for a balanced and diversified investment strategy.

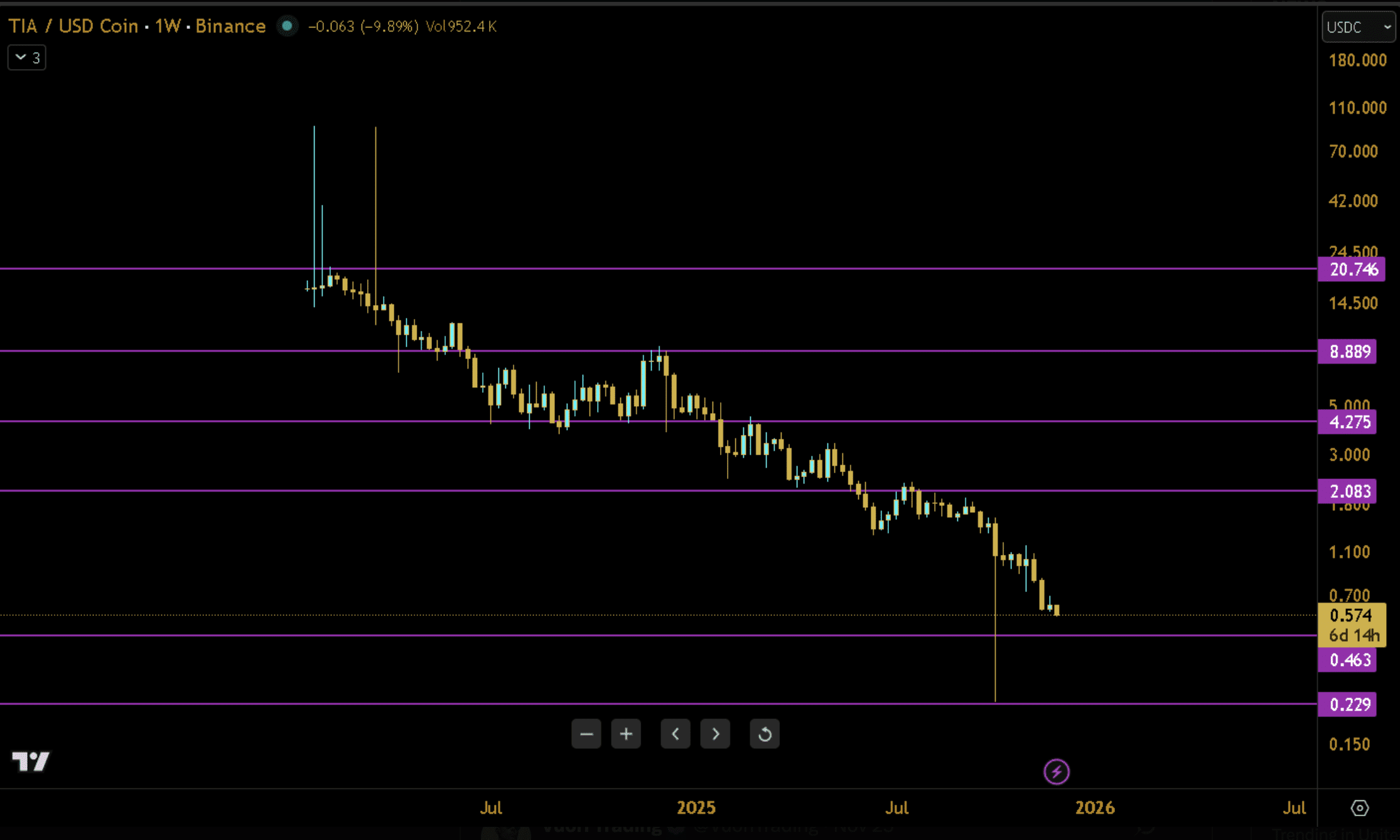

TIA Price Prediction: Navigating Uncertainty

The immediate impact of Astria’s closure is likely to be bearish for TIA. Market sentiment tends to be risk-averse in the face of uncertainty, and the news will likely trigger a period of price consolidation or even a correction. However, the long-term outlook for TIA will depend on how the Celestia community responds to this challenge. A proactive approach, focused on attracting new developers and strengthening the existing ecosystem, could help restore confidence and pave the way for future growth. Conversely, a passive response could exacerbate the negative sentiment and lead to further price declines.

Ultimately, the Celestia ecosystem’s ability to weather this storm will determine the fate of TIA. While the Astria situation presents a significant challenge, it also offers an opportunity for the ecosystem to demonstrate its resilience and solidify its position as a leading innovator in the modular blockchain space. The coming months will be crucial in shaping the narrative and defining the long-term trajectory of both Celestia and TIA.