🔥 Key Takeaways

Tom Lee’s Market Prognosis: A Potential Turning Point

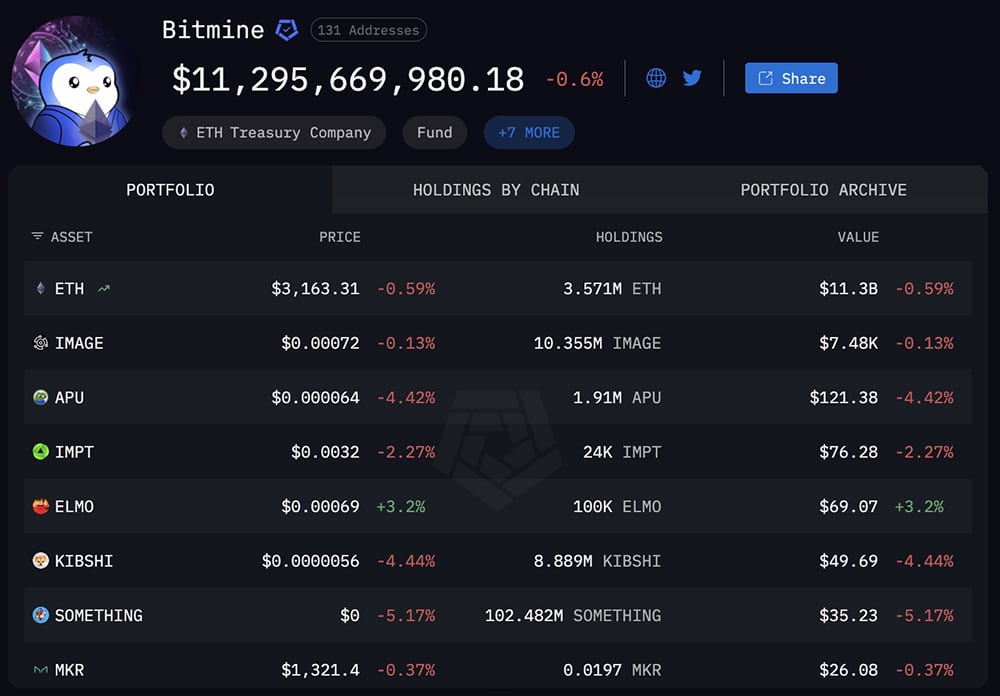

The cryptocurrency landscape is abuzz with excitement following comments from Tom Lee, co-founder of Fundstrat Global Advisors, who recently stated at the Binance Blockchain Week that the crypto market has already experienced its bottom. His assertion is particularly timely, as it arrives amid a backdrop of accumulating institutional interest, notably represented by Bitmine’s substantial $131 million investment in Ethereum (ETH) and Bitcoin (BTC).

The Implications of a Market Bottom

Lee’s remarks challenge the traditional four-year market cycle, suggesting that we may be entering a phase of renewed growth sooner than anticipated. This perspective resonates strongly with investors who have faced considerable volatility over the past year. If the market has truly bottomed, we could witness a shift in sentiment that may catalyze further institutional investment, potentially igniting a bullish trend.

Bitmine’s Strategic Accumulation

Bitmine’s recent acquisition of significant cryptocurrency holdings is a notable indicator of institutional confidence in the market. Their commitment to investing heavily in both ETH and BTC underscores a strategic bet on the long-term value of these assets. Such moves often signal to retail investors that the market is ripe for recovery, as institutions typically have access to more data and insights that guide their investment decisions.

Why It Matters

The importance of these developments cannot be overstated. Lee’s declaration, combined with Bitmine’s aggressive buying strategy, could serve as a catalyst for a market rebound, fostering a sense of optimism among investors. If Bitcoin maintains its value above $92,000, it could bolster market stability and attract further investment. Additionally, the prospect of breaking free from the historical four-year cycle may invite a new wave of innovation and interest in the cryptocurrency space.

As we move forward, monitoring the interplay between investor sentiment, institutional accumulation, and Bitcoin’s price movements will be crucial. The coming weeks will be critical as we gauge whether this optimism translates into sustainable growth or if market realities will temper expectations.