🔥 Key Takeaways

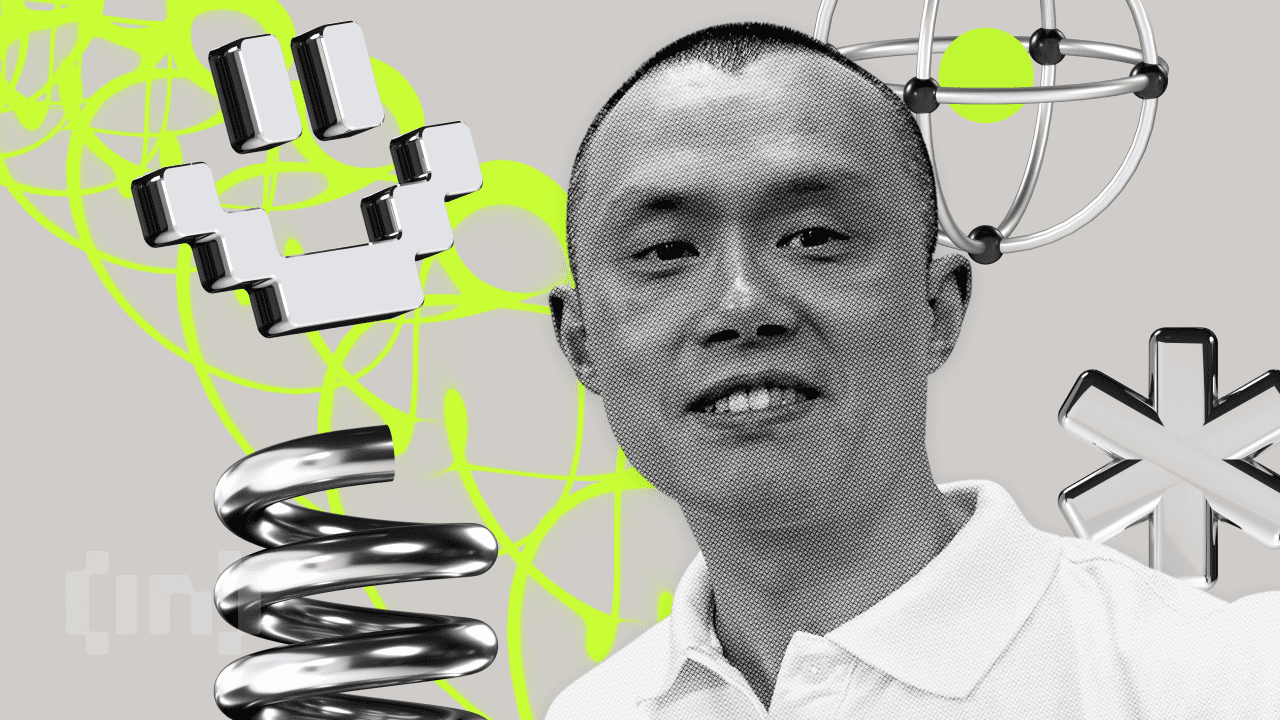

- Changpeng Zhao (CZ) denies claims of a BlackRock ETF for Aster (ASTER), clarifying misinformation.

- The incident highlights the volatility and susceptibility of crypto markets to rumors.

- CZ’s personal investment in Aster raises questions about the influence of prominent figures in crypto.

Understanding the Misinformation in Crypto Markets

Recently, Changpeng Zhao (CZ), the former CEO of Binance, took to social media to refute claims that BlackRock, the largest asset manager globally, had filed for a staked Aster (ASTER) exchange-traded fund (ETF). This misinformation not only caused a stir within the crypto community but also put significant pressure on the price of Aster, highlighting the fragile nature of market sentiment and the power of viral news.

The Impact of Misinformation

The crypto market is particularly susceptible to speculation and rumor, making it imperative for investors to critically assess the information they encounter. CZ’s strong denial of the BlackRock ETF claim is essential not just for Aster but for the broader crypto ecosystem. When influential figures like CZ are linked to speculative narratives, the effects can ripple through the market, leading to dramatic price fluctuations based solely on unverified claims.

Why It Matters

The implications of this incident extend beyond just Aster. It serves as a reminder of the potential dangers of misinformation in a space that is already volatile. As BlackRock’s involvement in the crypto sector has been closely watched, any rumors regarding their activity can spark immediate reactions from traders and investors. Such reactions can lead to panic selling or inflated buying pressures, further destabilizing prices.

This incident underlines the importance of reliable news sources and fact-checking in the crypto space. With many traders relying on social media for updates, the potential for misinformation to cause significant market disruption is high. As we move forward, the need for transparency and accountability in crypto information dissemination cannot be overstated.

Looking Ahead

As the crypto market matures, the role of institutional investors like BlackRock will likely continue to grow. The connection between established financial entities and decentralized platforms will be critical in shaping the future landscape. However, as seen with the recent Aster situation, the market must also navigate the complexities of speculation and rumor. For investors, this means staying informed through trusted channels and exercising caution in their trading strategies.