🔥 Key Takeaways

- MemeCore’s price has surged by 10%, indicating strong buyer interest.

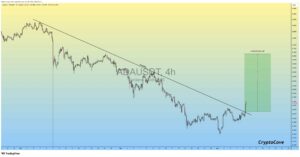

- A critical resistance level remains, which could hinder further upward momentum.

- The outcome of this resistance test will significantly influence market sentiment and future price action.

Understanding MemeCore’s Recent Price Movements

MemeCore has recently experienced a notable price increase of 10%, suggesting a resurgence of buyer interest in the project. This uptick is particularly significant given the overall market conditions, which have shown mixed signals. However, despite this positive movement, the asset faces a formidable resistance level that could dictate its next steps in the market.

The Role of Resistance in Market Dynamics

Resistance levels are critical in technical analysis, serving as psychological barriers that can halt upward price movements. For MemeCore, the current resistance appears to be a key factor in determining whether it can sustain its momentum. If the price breaks through this ceiling, it could lead to a substantial rally, attracting more traders and investors looking to capitalize on the momentum. Conversely, failure to breach this level could result in a pullback, leading to increased selling pressure.

Why It Matters

The implications of MemeCore’s price action extend beyond its immediate market presence. Should it successfully navigate through the resistance, it could signify a broader shift in market sentiment towards meme coins, potentially sparking renewed interest and investment in this niche. This situation reflects the broader trends within the cryptocurrency market, where speculative assets often experience rapid fluctuations based on market sentiment and investor psychology. For stakeholders, understanding these dynamics is crucial for making informed investment decisions.

Looking Ahead

As we move forward, traders and investors should closely monitor MemeCore’s price action in relation to the identified resistance level. The next few trading sessions will be pivotal in determining whether the current bullish sentiment can translate into a breakout. Additionally, external factors such as regulatory developments and market trends will play an essential role in shaping the trajectory of MemeCore and similar assets.

In conclusion, while the recent price surge is a positive sign for MemeCore, the road ahead is fraught with challenges. A decisive break above resistance could pave the way for a new phase of growth, while failure to do so may lead to increased caution among investors. Staying informed and adaptable will be key for those navigating this volatile landscape.