🔥 Key Takeaways

- Stablecoin-related crime is rising, with an 8% increase in crypto hacks in 2025 compared to 2024.

- The New York Times’ recent report has drawn criticism from the crypto industry, labeling it a “total hit piece.”

- Industry stakeholders argue that negative narratives hinder innovation and broader adoption of cryptocurrencies.

Understanding the Backlash Against the NYT Stablecoin Crime Report

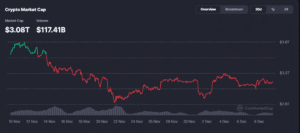

The crypto landscape has recently been rocked by a report from the New York Times that claims a significant uptick in stablecoin-related crime. The report highlights an alarming 8% increase in crypto hacks in 2025 compared to the previous year. This statistic has reignited fears about the security of digital assets and raised questions about the regulatory environment surrounding stablecoins.

Why It Matters

The rise in hacking incidents not only damages the reputation of stablecoins but also poses significant risks to investors and users. The perception of instability can deter potential adopters, undermining the efforts of innovators who aim to create safer and more reliable digital financial systems. Moreover, the backlash against the NYT report indicates a deeper tension between traditional media narratives and the burgeoning crypto industry. Stakeholders are concerned that negative portrayals could stifle the growth and acceptance of cryptocurrencies.

The Industry’s Reaction

Responses from industry leaders have been swift and pointed. Many argue that the NYT’s framing of stablecoins as synonymous with criminality is misleading and unbalanced. Critics have labeled the report a “total hit piece,” suggesting that it fails to account for the broader context of financial crime, which is prevalent across all sectors, not just crypto. The argument here is that while crime exists in the crypto space, it is not uniquely tied to stablecoins or even digital currencies as a whole.

The Bigger Picture

As the crypto market continues to evolve, it is crucial to foster an environment of transparency and constructive dialogue. Highlighting criminal activity without addressing the innovations and protective measures being implemented can create a skewed perception of the industry. Initiatives such as enhanced security protocols and regulatory compliance are already being adopted to mitigate risks, yet these advancements often go unreported. The industry must find ways to communicate its progress and the positive aspects of stablecoins more effectively.

The conversation surrounding stablecoins is not merely a matter of crime statistics; it is also about the future of financial systems. As regulatory bodies contemplate the best approaches to governance, the insights drawn from this NYT report could serve as a catalyst for more robust discussions on security and regulation in the crypto space.

Looking Forward

Moving forward, the challenge for the crypto industry will be to navigate the complex landscape of public perception while simultaneously addressing genuine security concerns. Engaging with media narratives, correcting misinformation, and highlighting positive developments are critical for ensuring the long-term viability and acceptance of stablecoins and cryptocurrencies at large.

In conclusion, while the 8% rise in hacks is concerning, it is essential to contextualize this statistic within the broader narrative of technological advancement and regulatory evolution. The industry must remain vigilant and proactive in fostering a safer and more inclusive financial ecosystem.