🔥 Key Takeaways

- Bitcoin’s price has reclaimed the $91K level, indicating a potential bull run.

- Three key on-chain metrics are flashing pre-bullish signals: the Coinbase Premium Gap, Fear & Greed Index, and long/short ratio.

- Institutional inflow from US institutions is recovering, contributing to the optimistic outlook.

Bitcoin’s Bullish Outlook: A New Year, A New Hope

As the new year begins, Bitcoin bulls have reason to be optimistic. The largest cryptocurrency by market cap has reclaimed the $91K level, and three key on-chain metrics are signaling a potential bull run. The Coinbase Premium Gap, which measures the difference between the Coinbase Pro price and the Binance price, is bouncing back, indicating a recovery in institutional inflow. This is a significant development, as institutional investment is often seen as a key driver of Bitcoin’s price.

On-Chain Metrics Flashing Bullish Signals

The Fear & Greed Index, which measures market sentiment, has jumped, indicating a shift from fear to greed among investors. This is a bullish sign, as it suggests that investors are becoming more confident in the market. Furthermore, the long/short ratio remains above 1.0, despite recent deleveraging, indicating that investors are still bullish on Bitcoin’s prospects. These on-chain metrics, combined with the recovery in institutional inflow, are flashing pre-bullish signals that suggest a potential bull run is on the horizon.

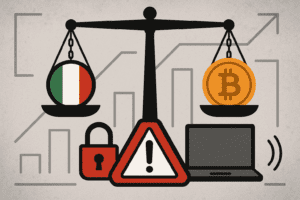

US Institutions Leading the Charge

The recovery in institutional inflow is being led by US institutions, which are increasingly investing in Bitcoin. This is a significant development, as US institutions have been slower to adopt Bitcoin compared to their European and Asian counterparts. The increasing investment from US institutions is a vote of confidence in Bitcoin’s prospects and is likely to contribute to the optimistic outlook for the cryptocurrency.