🔥 Key Takeaways

- Cathie Wood foresees a robust liquidity wave driven by AI investments and tax cuts.

- Lower interest rates may catalyze a new bull market, positioning the U.S. economy for growth.

- Increased productivity could significantly impact various sectors, including crypto and technology.

The Economic Landscape: A New Era of Liquidity

In a recent discussion, Cathie Wood, the founder of Ark Invest, articulated her vision for the U.S. economy, suggesting that it is on the verge of a significant transformation driven by liquidity and productivity. Wood’s analysis centers around the implications of tax cuts, investments in artificial intelligence (AI), and the effects of falling interest rates, all of which she believes are paving the way for a renewed bull market.

Understanding the Drivers of Change

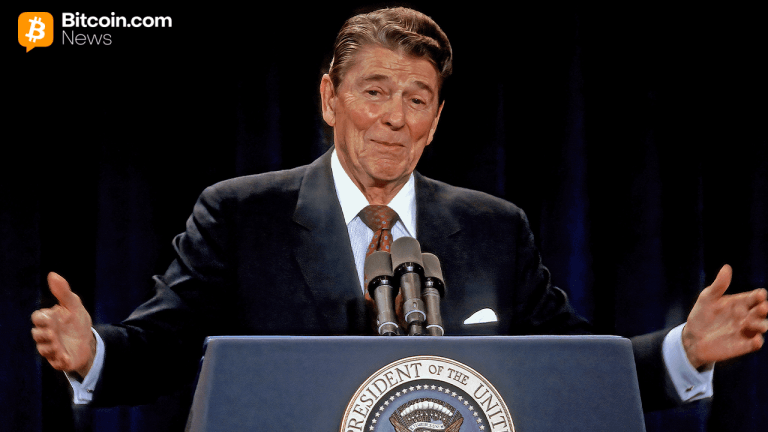

Wood likens the current economic conditions to a form of “Reaganomics on steroids,” emphasizing the potential for an explosive increase in capital spending. The rationale is clear: as companies invest heavily in AI technologies, efficiency and productivity are likely to soar. This technological revolution not only enhances operational capabilities but also creates a fertile ground for innovation across industries, including the burgeoning crypto sector.

Moreover, the anticipated tax cuts are expected to inject additional liquidity into the economy. This influx can lead to increased consumer spending and business investment, further stimulating economic activity. The combined effect of these factors suggests that we might be witnessing the early stages of a substantial economic recovery.

Why It Matters

The implications of Wood’s predictions extend far beyond traditional markets. If her forecast of a productivity boom materializes, it could significantly influence the crypto market as well. Increased liquidity often leads to greater investment in digital assets, as institutional and retail investors seek to capitalize on the growth opportunities that arise from enhanced productivity. Furthermore, a thriving economy could bolster confidence in cryptocurrencies as viable alternatives to traditional financial systems, encouraging broader adoption.

As the U.S. economy potentially transitions into this new phase, it will be crucial for investors to monitor these developments closely. The interplay between liquidity, tax policy, and technological advancement will undoubtedly shape market dynamics in the months and years to come. Stakeholders in the crypto space should remain vigilant, as shifts in traditional markets often herald significant changes in the digital asset landscape.

In conclusion, if Cathie Wood’s outlook proves accurate, the convergence of AI, tax cuts, and low interest rates could unleash a wave of economic growth that reinvigorates the market, presenting compelling opportunities for investors in the crypto realm.