🔥 Key Takeaways

Understanding the Significance of Aster DEX in the Current Market Landscape

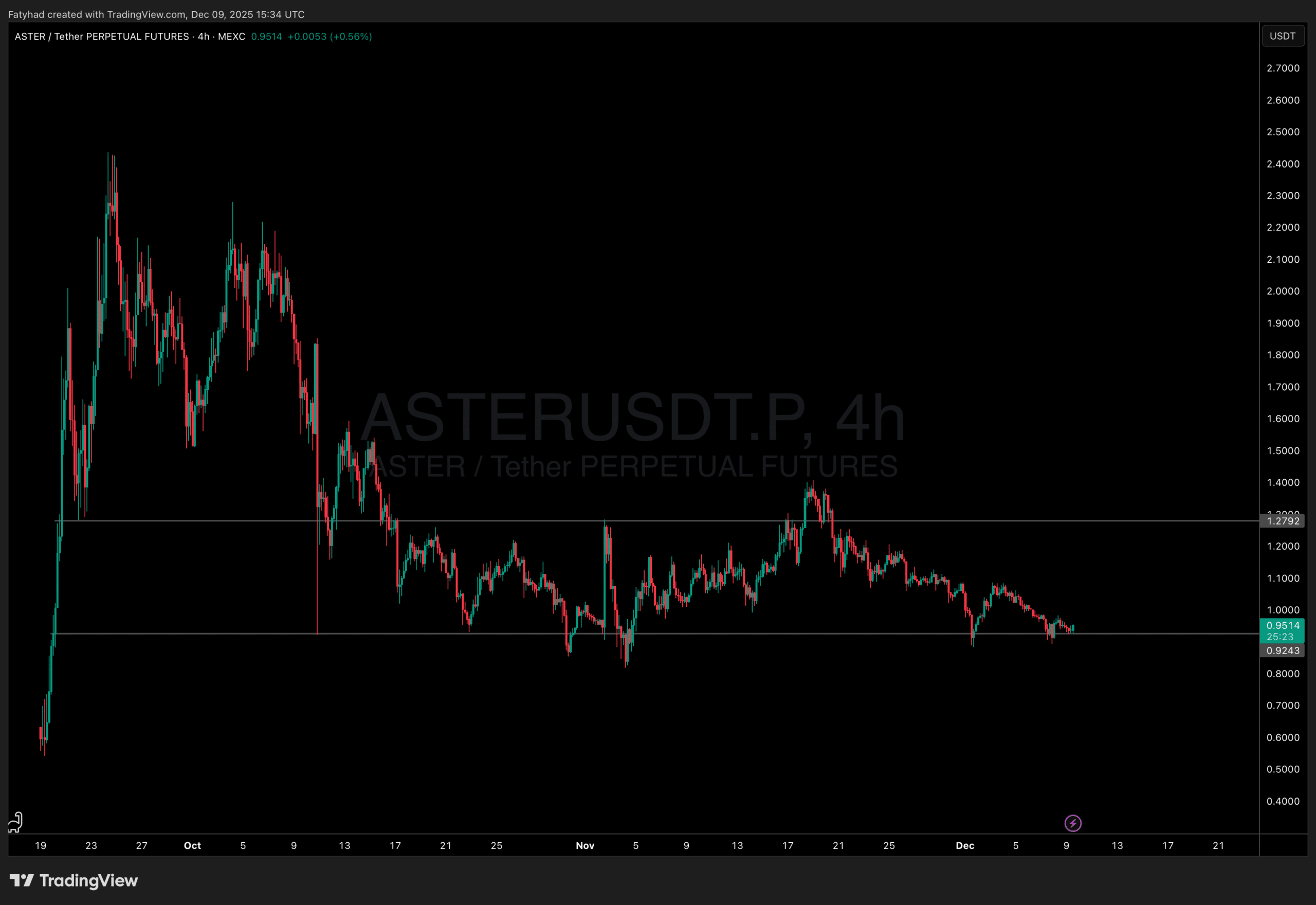

As the crypto market navigates through a volatile environment, the spotlight is shifting towards Aster DEX, particularly with the impending S4 buybacks set to begin tomorrow. This event is not just a routine buyback; it signals a critical turning point for the ASTER token, which has already established its presence in the perpetual trading niche since its launch on the BNB Chain earlier this year. The anticipation around the buybacks is compounded by the upcoming Federal Open Market Committee (FOMC) meeting scheduled for Wednesday, which may lead to significant shifts in market sentiment based on potential interest rate cuts.

The Impact of S4 Buybacks on ASTER Price Dynamics

The S4 buybacks could serve as a much-needed catalyst for ASTER, potentially stabilizing its price and attracting new investors. Buybacks typically signal to the market that a project is confident in its future, often leading to increased demand as investors rush to capitalize on perceived undervaluation. Given the current market conditions, where uncertainty prevails due to macroeconomic factors, the buybacks could not only enhance liquidity but also bolster investor confidence in Aster DEX’s long-term viability. Historical data from previous buyback events across various cryptocurrencies suggests that such initiatives can lead to a positive price trajectory, making this a crucial moment for ASTER.

Market Sentiment: The FOMC Meeting’s Potential Influence

The timing of the S4 buybacks coincides with the FOMC meeting, making it essential to consider how market sentiment may shift based on the outcomes of this meeting. Should the FOMC signal a dovish stance or announce rate cuts, the crypto market, particularly altcoins like ASTER, may experience a surge in positive sentiment. Conversely, any indication of tightening monetary policy could lead to a more cautious approach from investors. This dual impact of the buybacks and FOMC outcomes creates a layered complexity in forecasting ASTER’s price movement, making it imperative for investors to remain vigilant.

Conclusion: A Pivotal Moment for Aster DEX

In conclusion, the S4 buybacks starting tomorrow represent a significant opportunity for ASTER, potentially acting as a turning point in its price trajectory. Coupled with the macroeconomic landscape shaped by the upcoming FOMC meeting, Aster DEX finds itself at a critical juncture. Investors and market analysts alike will be closely monitoring how these developments unfold, particularly in a market characterized by rapid changes and heightened volatility. As Aster DEX continues to carve out its niche in the perpetual trading ecosystem, the outcomes of these events could very well define its path moving forward.