The January Blues: Why Selling Bitcoin May Not Be the Best Decision

🔥 Key Takeaways

A Lesson from History

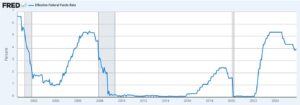

As we enter the new year, traders and investors are weighing their options, considering whether to hold or sell their Bitcoin (BTC) holdings. However, a closer look at historical price trends suggests that selling Bitcoin in January might not be the best decision. In fact, it could be the most expensive “safe” move traders make, as the calendar has a habit of turning sellers into late buyers.

Data shows that January has traditionally been a bullish month for Bitcoin, with prices often experiencing a significant surge. This trend has been observed in multiple years, making it a compelling argument for traders to hold onto their Bitcoin holdings. By selling in January, traders may be missing out on potential gains, only to buy back in at higher prices later.

The Psychology of Selling

So, why do traders sell in January, despite the historical evidence suggesting it may not be the best decision? The answer lies in the psychology of selling. Traders often sell during periods of uncertainty or when they perceive a potential downturn in the market. However, this fear-based approach can lead to missed opportunities and lower returns in the long run.

A Strategic Approach

Rather than relying on emotions, traders should adopt a strategic approach to managing their Bitcoin holdings. This includes conducting thorough research, analyzing market trends, and setting clear goals. By doing so, traders can make informed decisions that align with their investment objectives, rather than succumbing to fear or uncertainty.

Conclusion

In conclusion, selling Bitcoin in January may not be the best decision, given the historical price trends. Traders should exercise caution and consider the potential consequences of their actions. By adopting a strategic approach and keeping a long-term perspective, traders can maximize their returns and avoid costly mistakes.