🔥 Key Takeaways

- Michael Saylor, Chairman of Strategy (MSTR), urges calm as Bitcoin experiences a 299% liquidation imbalance.

- $50.46 million in Bitcoin shorts were liquidated in just 24 hours, boosting the bulls.

- The sudden surge in Bitcoin price highlights the volatility and potential risks in the crypto market.

- Saylor’s advice to “be cool” emphasizes the importance of maintaining a long-term perspective in volatile markets.

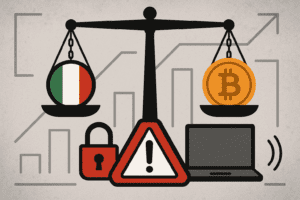

Michael Saylor Urges Calm as Bitcoin Rockets 299% in Liquidation Imbalance

In a recent market surge, Bitcoin has experienced a dramatic 299% liquidation imbalance, with $50.46 million in Bitcoin shorts being liquidated within a 24-hour period. This significant shift has propelled the cryptocurrency’s value and has caught the attention of industry leaders and investors alike. Strategy (MSTR) Chairman Michael Saylor has taken to the stage to remind everyone to “be cool” amidst the volatility.

Saylor, a prominent figure in the crypto community and a staunch advocate for Bitcoin, has long been known for his strategic investments in the cryptocurrency. His company, MicroStrategy, has been one of the largest institutional holders of Bitcoin, and his insights often carry weight in the market. In light of the recent liquidation imbalance, Saylor’s message of calm is particularly timely.

The liquidation of $50.46 million in Bitcoin shorts represents a significant turning point in the market. Shorts, or bets against the rise in Bitcoin’s value, have been liquidated en masse, leading to a surge in the cryptocurrency’s price. This imbalance, favoring the bulls, has created a ripple effect across the market, with many investors reevaluating their positions.

However, Saylor’s advice to “be cool” is a reminder that while short-term volatility can be intense, it is essential to maintain a long-term perspective. The crypto market is known for its volatility, and sudden price movements can often be driven by a combination of technical factors, market sentiment, and broader economic conditions.

The sudden surge in Bitcoin’s price also highlights the potential risks and rewards of investing in cryptocurrencies. While the upside can be substantial, the downside can be equally significant. Saylor’s message is a call to action for investors to stay disciplined and to focus on their long-term investment strategies rather than getting caught up in the short-term noise.

As the market continues to evolve, Saylor’s advice serves as a guiding principle for both new and experienced investors. By staying calm and maintaining a strategic approach, investors can navigate the ups and downs of the crypto market with greater confidence and resilience.