🔥 Key Takeaways

Introduction: A New Era for Crypto Spending

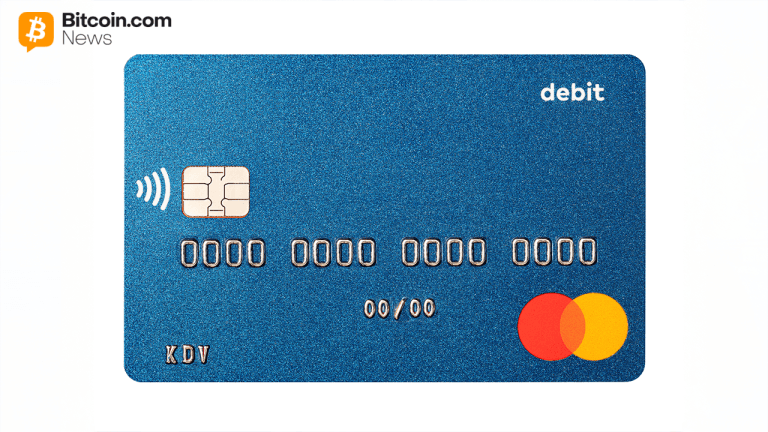

Swissborg’s recent announcement of a partnership with Mastercard marks a significant milestone in the evolution of cryptocurrency usability. Scheduled for launch in 2026, this initiative aims to introduce a crypto debit card that will allow users to seamlessly spend their digital assets at more than 150 million locations globally. This move not only enhances the usability of cryptocurrencies but also positions Swissborg as a key player in the growing intersection of traditional finance and digital currencies.

The Why It Matters: Bridging the Gap Between Crypto and Everyday Spending

The introduction of the Swissborg Mastercard debit card is pivotal for several reasons. Firstly, it tackles one of the longstanding barriers to cryptocurrency adoption: real-world usability. By allowing users to transact in digital currencies at millions of merchant locations, this initiative could significantly broaden the appeal of cryptocurrencies beyond niche markets. Furthermore, it enhances the liquidity of crypto assets, enabling holders to utilize their investments in everyday scenarios, from shopping to dining.

Moreover, this partnership could signal a broader acceptance of cryptocurrencies by major financial institutions. As Mastercard joins forces with Swissborg, it highlights an evolving landscape where traditional finance begins to embrace digital assets. This shift may encourage other financial institutions to explore similar collaborations, fostering an ecosystem where cryptocurrencies can thrive.

What This Means for the Crypto Market

The implications of this partnership extend beyond just Swissborg and Mastercard. By facilitating easier spending of digital assets, it is likely to drive further mainstream adoption of cryptocurrencies. This could lead to an increase in demand for various cryptocurrencies as people seek to hold assets that can be easily spent, potentially influencing market dynamics.

Investors may view this development as a validation of the crypto space, prompting more traditional investors to consider entering the market. Furthermore, the introduction of user-friendly financial products like the Swissborg Mastercard can lower the entry barriers for newcomers, creating a more inclusive environment for crypto engagement.

In summary, the collaboration between Swissborg and Mastercard is not merely a product launch; it is a strategic move that could redefine how digital assets are perceived and utilized in everyday life. As we look towards 2026, the ripple effects of this partnership may well shape the future trajectory of cryptocurrency adoption.

For more insights on cryptocurrency trends and market analysis, visit [CoinDesk](https://www.coindesk.com) and [CryptoSlate](https://cryptoslate.com).