🔥 Key Takeaways

- Do Kwon’s upcoming sentencing in the US highlights the global ramifications of crypto fraud.

- South Korean penalties are under scrutiny, potentially impacting international regulatory frameworks.

- This case may set precedents for future prosecutions in the crypto space.

Understanding the Implications of Do Kwon’s Sentencing

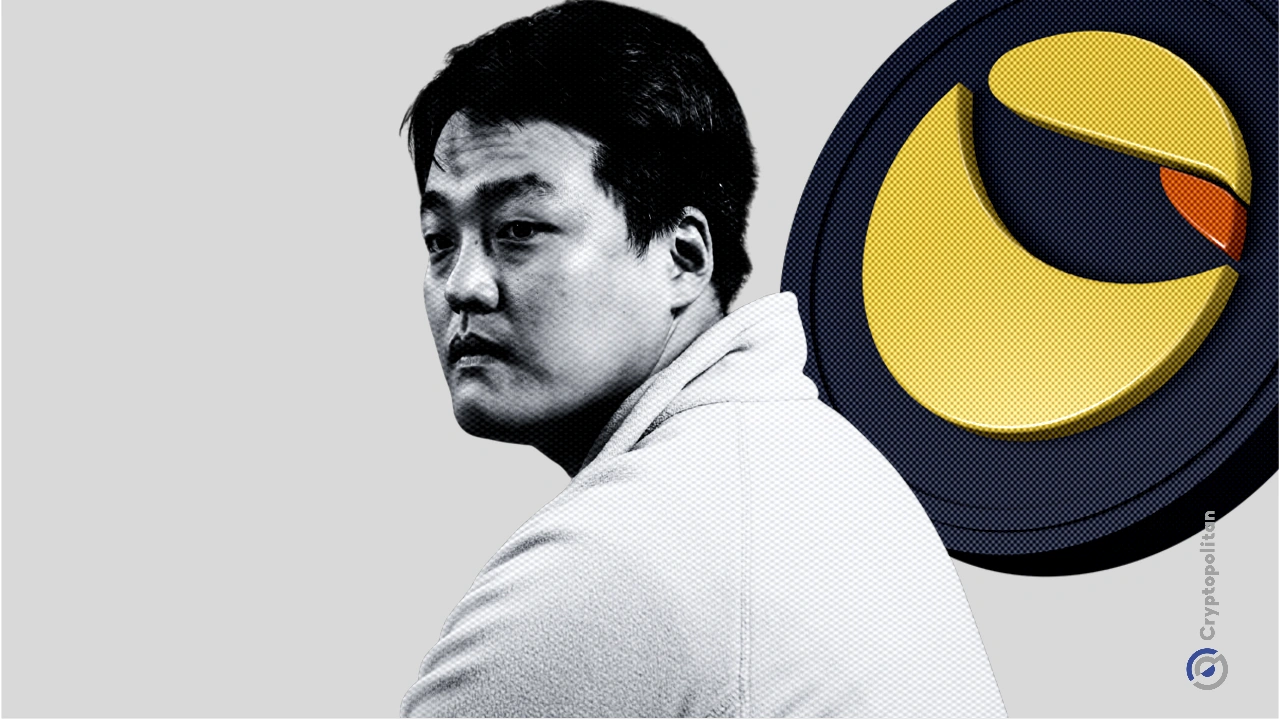

As the crypto world watches closely, the impending sentencing of Do Kwon on December 11 carries significant implications not only for the former CEO of Terraform Labs but also for the broader cryptocurrency market and regulatory landscape. Kwon, who has pleaded guilty to charges of wire fraud and conspiracy, faces a critical juncture that could affect investor sentiment and regulatory approaches worldwide.

The ‘Why It Matters’ Section

The scrutiny of South Korea’s penalties against Kwon is noteworthy. It brings to light the complexities of international law and how jurisdictions interact when it comes to financial crimes in the crypto domain. As the US judicial system examines the case, the outcome may influence future regulations in South Korea and beyond, creating a ripple effect through the global financial ecosystem.

Global Context and Regulatory Ramifications

Do Kwon’s case is emblematic of a growing trend where authorities are taking a firmer stance on crypto-related fraud. With the rise of decentralized finance and the increasing sophistication of scams, regulatory bodies are under pressure to establish clear guidelines and enforcement mechanisms. The outcomes of Kwon’s sentencing may serve as a litmus test for how similar cases will be handled in the future, potentially reshaping investor confidence and market dynamics.

Moreover, the discussion around the penalties imposed by South Korea could lead to a more unified international approach to tackling cryptocurrency fraud. As various countries grapple with the challenges posed by digital assets, the need for cohesive regulations becomes increasingly pressing. The outcome of this case may encourage other nations to either adopt stricter regulations or collaborate on international enforcement efforts.

Investors and stakeholders in the crypto space should remain vigilant. The fallout from Kwon’s case could lead to increased regulatory scrutiny across the board, potentially affecting market liquidity and the operational capabilities of crypto firms. The market’s response to these developments will be crucial in shaping its future trajectory.

For further insights into the implications of this case and ongoing developments in the crypto sector, follow the latest updates from reputable sources such as Reuters and Bloomberg.