🔥 Key Takeaways

Understanding the Current Landscape After FOMC Rate Cuts

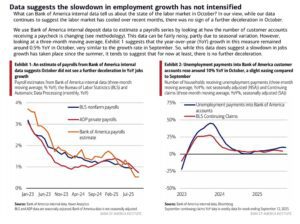

The recent Federal Open Market Committee (FOMC) meeting marked a significant moment for both traditional and cryptocurrency markets. Following the delivery of the third 25 basis point rate cut of the year, the Federal Reserve adopted a notably cautious tone, citing persistent inflation risks and indications of slower economic growth. This decision has contributed to ongoing pressure on asset prices across various sectors, including cryptocurrencies, which have historically been sensitive to macroeconomic indicators.

The Role of Crypto Whales in the Current Market

Despite the bearish sentiment following the rate cuts, crypto whales—individuals or entities holding significant amounts of cryptocurrency—appear to be seizing this moment as a buying opportunity. Their purchasing behavior often serves as a bellwether for retail investors and smaller market participants. The assets being targeted by these whales reveal insights into potential future trends in the crypto market. Notably, certain tokens that are less correlated with traditional financial markets are gaining traction, suggesting a strategic pivot in response to macroeconomic shifts.

Why It Matters

The actions of crypto whales during periods of economic uncertainty can influence market sentiment and price movements. Their confidence in the market can serve as a stabilizing force, potentially attracting more retail investors who may be hesitant to enter during bearish trends. As these large holders accumulate assets, it may indicate a belief in the long-term viability and potential upside of specific cryptocurrencies, despite short-term volatility. Furthermore, this behavior can lead to a more decentralized ownership structure, which is crucial for the long-term health of the crypto ecosystem.

Market Implications and Future Outlook

The cautious outlook from the Federal Reserve, combined with the strategic buying by whales, may signal an impending shift in market dynamics. If inflation continues to pose a challenge, cryptocurrencies that can provide utility or hedge against traditional market risks may see increased demand. Additionally, as the broader economic narrative unfolds, we may witness evolving investment strategies that prioritize digital assets, particularly those perceived as resilient during economic downturns.

In conclusion, while the immediate market reaction to the FOMC rate cuts has been one of caution, the proactive measures taken by crypto whales suggest a deeper understanding of long-term value creation. As we navigate through this complex landscape, it will be essential to monitor these trends closely, as they may define the next phase of the cryptocurrency market.