🔥 Key Takeaways

Understanding Bitcoin Beyond Speculation

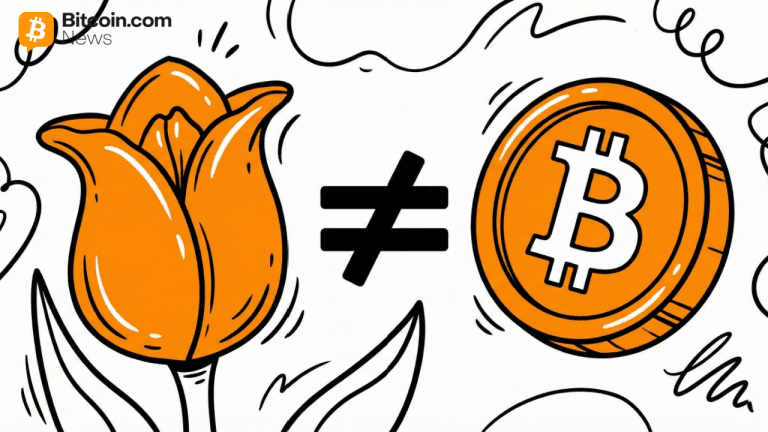

The recent comparisons between Bitcoin and the infamous tulip mania of the 1600s have sparked considerable debate. While at first glance, the parallels drawn between the two phenomena seem compelling—especially given the speculative nature of both—such analogies fail to grasp the nuanced realities of Bitcoin’s value proposition. This analysis seeks to elucidate why Bitcoin is far from being a mere digital tulip and why it stands to be a cornerstone of the future financial ecosystem.

The Tulip Mania Analogy: A Misguided Comparison

Tulip mania represents a historical episode characterized by rampant speculation that ultimately led to a market crash. Critics of Bitcoin frequently cite this event to argue that Bitcoin is merely a speculative bubble destined to burst. However, this comparison is fundamentally flawed. Unlike tulips, which had no intrinsic value beyond aesthetic appeal, Bitcoin is built on a robust technological framework that offers both scarcity and utility.

Bitcoin operates on a decentralized network, making it a revolutionary form of digital currency that transcends traditional financial systems. Its supply is capped at 21 million coins, ensuring scarcity—a feature that tulips lacked in their oversaturated market. Furthermore, Bitcoin’s underlying technology, the blockchain, enables secure and transparent transactions, providing a use case that tulip bulbs could never offer.

Analyzing Bitcoin’s True Value Proposition

Focusing solely on Bitcoin as a store of value ignores its broader implications. While it has garnered attention for its potential as a hedge against inflation and currency devaluation, Bitcoin’s role as a decentralized financial asset is equally important. The emergence of decentralized finance (DeFi) platforms and the growing acceptance of Bitcoin as a payment method highlight its evolving utility in modern financial transactions.

Moreover, Bitcoin’s influence extends to social and political realms, championing the cause of financial sovereignty and privacy. As governments continue to impose stringent regulations and surveillance, the appeal of a decentralized currency becomes increasingly pronounced. This shift speaks volumes about Bitcoin’s potential as a revolutionary asset class that could redefine the way we view money.

Why It Matters: The Future of Bitcoin

The ongoing discourse surrounding Bitcoin’s identity is crucial not only for investors but also for policymakers and financial institutions. Understanding that Bitcoin is not a fleeting fad akin to tulip mania is essential for fostering an environment where innovation can thrive. As institutional adoption grows and public sentiment shifts, Bitcoin’s legitimacy as a stable asset continues to solidify.

As we move forward, it is imperative to recognize Bitcoin’s intrinsic qualities that differentiate it from historical speculative bubbles. Its foundations in technology, community, and decentralization position it as a lasting force in the evolving landscape of finance.

For those interested in further exploring the implications of Bitcoin’s unique attributes, consider resources from Investopedia and Forbes.