🔥 Key Takeaways

Understanding Solana’s Current Market Position

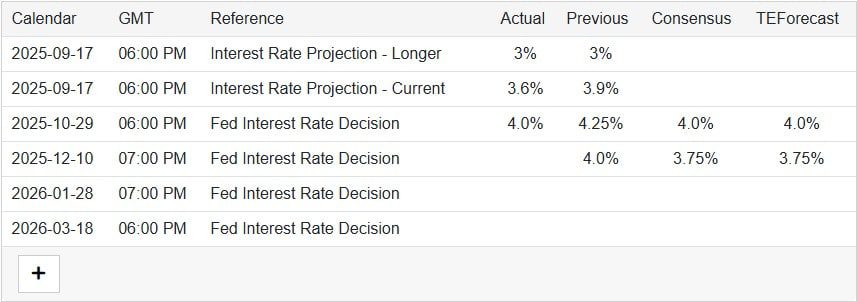

The cryptocurrency market is often influenced by macroeconomic events, and the upcoming Federal Open Market Committee (FOMC) meeting is no exception. As traders look towards this meeting, the sentiment surrounding Solana (SOL) is particularly noteworthy. With SOL managing to hold above the significant support level of $130, the stage appears to be set for a potential rebound.

Market Dynamics at Play

Solana’s ability to defend the $130 support level is crucial for its price stability. This level has become a psychological barrier for traders, and its defense signals confidence in the asset. Recent momentum indicators are turning bullish, suggesting that investor sentiment may be shifting in favor of Solana. Should this bullish trend continue, a move back towards the $200 mark could be within reach, especially if macroeconomic conditions favor liquidity in the market.

Why It Matters

The outcome of the FOMC meeting is likely to have far-reaching implications for the entire cryptocurrency market, including Solana. A dovish stance from the Federal Reserve could lead to increased liquidity, encouraging risk-on sentiment among investors. Conversely, a hawkish tone could dampen market enthusiasm. As Solana continues to carve out its niche in the competitive landscape of altcoins, the decisions made during this meeting could either catalyze its ascent or hinder its progress.

Looking Ahead

For traders and investors, the current price action of Solana serves as a litmus test for broader market sentiment. The defense of the $130 level combined with positive momentum indicators paints a hopeful picture. However, it is essential to remain vigilant as external factors, particularly the macroeconomic environment shaped by the FOMC, could play a decisive role in SOL’s short-term trajectory. Those looking to invest should consider these dynamics carefully, weighing both technical indicators and macroeconomic factors in their strategies.

In conclusion, the upcoming FOMC meeting holds the potential to be a game-changer for Solana. Traders should monitor the developments closely, as they could pave the way for a significant price movement in the near future.