🔥 Key Takeaways

- Stablecoin adoption is rapidly increasing across various sectors.

- Polygon (POL) is strategically positioned to benefit from this growth.

- Analysts are optimistic about the potential for POL price recovery amid a stablecoin supercycle.

Understanding the Stablecoin Supercycle and Its Implications for Polygon (POL)

The cryptocurrency market is undergoing a seismic shift, driven largely by the rapid adoption of stablecoins. This trend has led analysts to speculate whether we are on the brink of a “stablecoin supercycle”—a period characterized by explosive growth and widespread acceptance of stablecoin technologies. For Polygon (POL), a leading Layer 2 scaling solution for Ethereum, this could signify a pivotal moment that might reverse its recent sluggish price performance.

Why It Matters

The implications of a stablecoin supercycle are profound, not just for the broader crypto ecosystem but specifically for platforms like Polygon. With stablecoin usage soaring among banks, fintechs, and even sovereign entities, Polygon stands to gain significantly by facilitating seamless transactions and providing the infrastructure necessary for these digital assets. A resurgence in demand for POL could lead to enhanced liquidity, increased developer activity, and greater institutional interest, ultimately stabilizing and potentially boosting its market valuation.

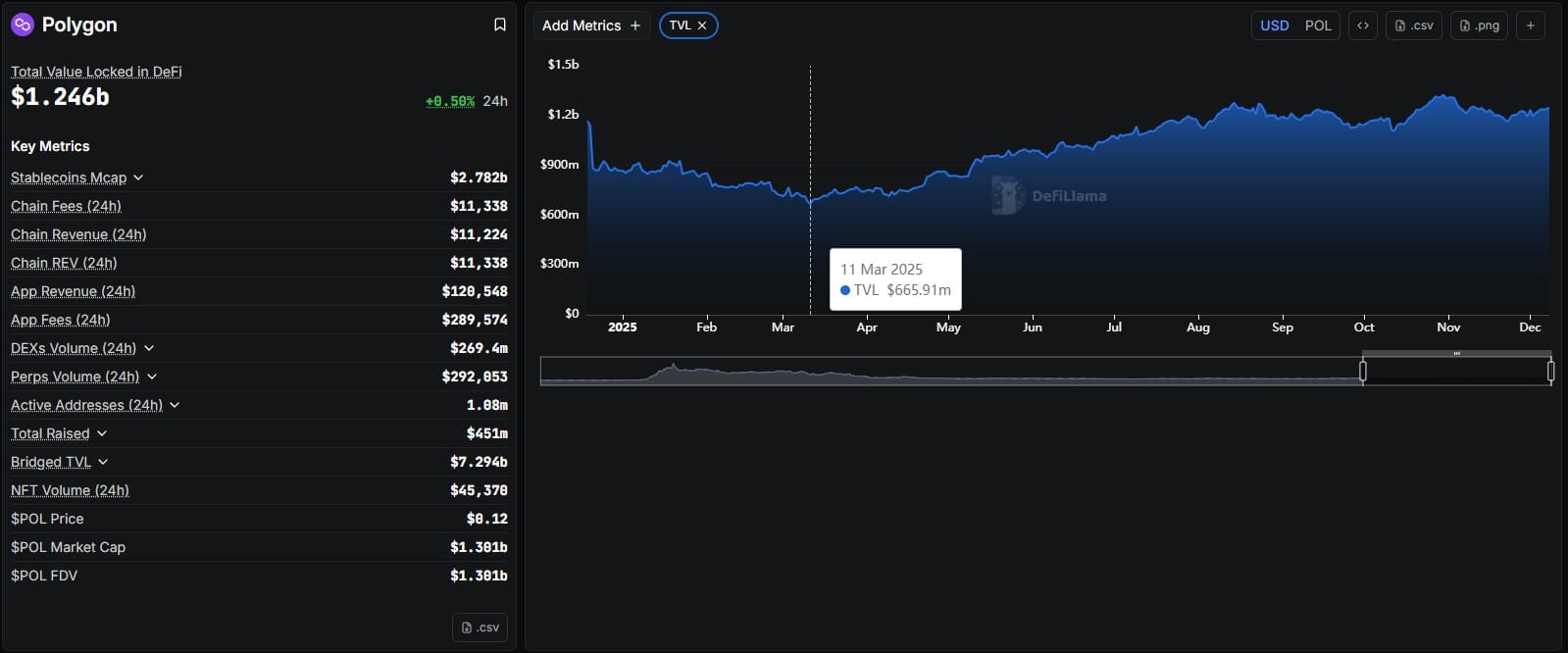

The Current Landscape for Polygon (POL)

Despite its innovative technology and strong community backing, Polygon has struggled to maintain a competitive price point in a market dominated by larger cryptocurrencies. As stablecoins become increasingly integral to financial transactions—spanning everything from e-commerce to remittances—Polygon’s ability to serve as a bridge between traditional finance and the decentralized world could be a game changer. Analysts are optimistic that if a supercycle does materialize, it could serve as a much-needed catalyst for POL’s price recovery.

Moreover, the ongoing developments within the Polygon ecosystem, including partnerships with various stablecoin projects, position it as a critical player in the evolving landscape. If the anticipated growth in stablecoin adoption continues, Polygon’s infrastructure will be crucial for enabling efficient transactions, which could, in turn, drive demand for POL.

Looking Ahead

As we move forward, the focus will be on how effectively Polygon can leverage the impending stablecoin supercycle to its advantage. With increasing collaboration across the finance and technology sectors, POL may find itself at the forefront of this transformation. The convergence of stablecoins with Polygon’s scalable solutions presents a unique opportunity for both price recovery and ecosystem growth.

Investors should closely monitor developments in the stablecoin space, as well as Polygon’s strategic initiatives. The potential for POL to rebound in price is contingent not only on external market conditions but also on the platform’s ability to innovate and adapt to the rapidly changing financial landscape.

For more insights on the implications of stablecoin trends, consider exploring resources from reputable sources like Forbes and CoinDesk.