🔥 Key Takeaways

- The renewed tension between Trump and Powell raises questions about future Federal Reserve policies.

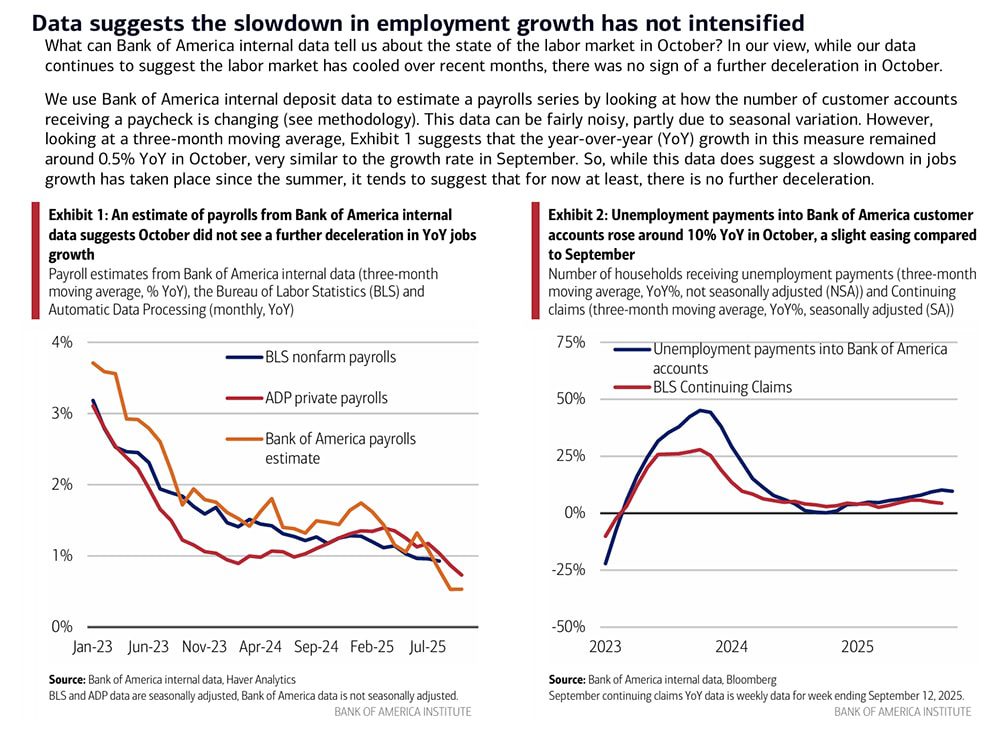

- Weaker labor data and mixed PMI readings signal potential shifts in monetary policy ahead of the FOMC meeting.

- Political dynamics may further complicate the Fed’s decision-making process, impacting market confidence.

The Current Landscape of the Federal Reserve

The dynamics surrounding the Federal Reserve have become increasingly complex as political narratives intertwine with economic indicators. Recently, the friction between former President Donald Trump and Federal Reserve Chair Jerome Powell has resurfaced, adding an unpredictable layer to upcoming monetary policy decisions. As we approach the critical Federal Open Market Committee (FOMC) meeting in December, several economic reports, including jobless claims, PMI data, and overall labor market performance, are generating mixed signals that could heavily influence the Fed’s direction.

Significance of Economic Indicators

The recent economic data reveals a landscape of uncertainty. Weaker labor readings suggest that the job market may not be as robust as previously thought, which could prompt the Fed to reconsider its approach to interest rates and quantitative tightening. Additionally, the Purchasing Managers’ Index (PMI) data has shown unevenness, indicating varied performance across sectors, further complicating the Fed’s task of maintaining economic stability.

This backdrop sets the stage for a potentially pivotal FOMC meeting. With the Fed’s previous trajectory leaning towards quantitative tightening, the emergence of these economic indicators may catalyze a shift towards a more accommodative stance. This pivot could be interpreted as a response to both the political pressures exerted by Trump and the economic realities at play.

Political Dynamics at Play

The political implications of the Trump-Powell relationship cannot be understated. Trump’s previous criticisms of Powell’s handling of monetary policy have led to speculation about whether he would seek to influence or even veto Powell’s position should he return to the White House. This scenario could undermine the Fed’s independence, a cornerstone principle of U.S. monetary policy. As markets strive for stability and predictability, the potential for political intervention raises the stakes significantly.

Why It Matters

Understanding the interplay between economic data and political dynamics is crucial for market participants. The Federal Reserve’s decisions have far-reaching implications for interest rates, inflation, and overall economic growth. Should the Fed shift its policy in response to political pressures, it could lead to increased volatility in financial markets, including the crypto space. Cryptocurrencies, often viewed as alternatives in times of economic uncertainty, could see significant price fluctuations as investors react to potential changes in Fed policy.

As we move closer to the FOMC meeting, paying attention to labor market trends and political developments will be essential for making informed investment decisions. The potential for a policy shift amidst political turmoil requires vigilance from both seasoned investors and newcomers alike.