🔥 Key Takeaways

Understanding the Sentence and Its Implications

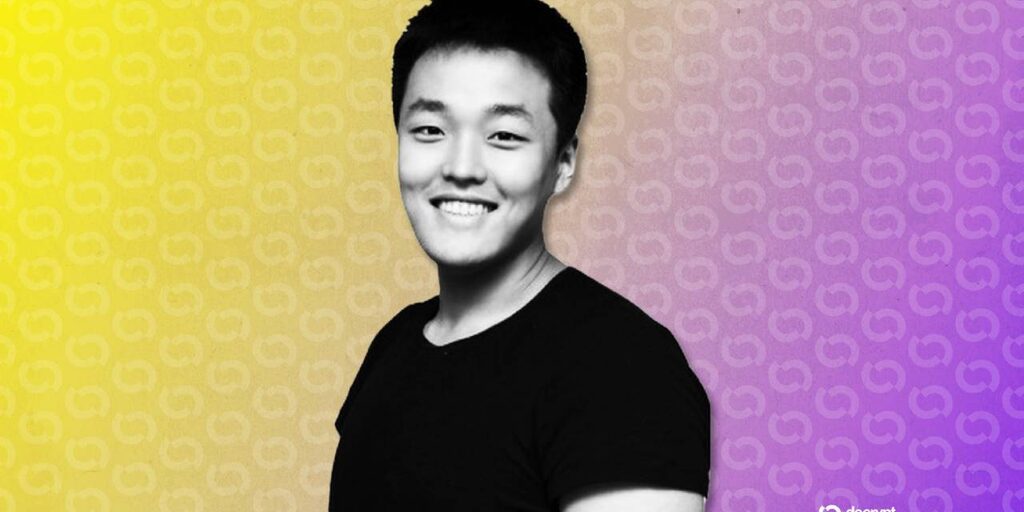

The recent sentencing of Do Kwon to 15 years in prison marks a significant moment in the realm of cryptocurrency, particularly concerning the collapse of Terra’s UST and Luna. This incident, which resulted in a staggering loss of $40 billion, not only devastated investors but also shook the foundations of confidence in decentralized finance (DeFi). The judgment against Kwon serves as a stark reminder of the consequences that can arise from mismanagement and lack of transparency in the crypto sector.

Why It Matters

The ramifications of Kwon’s sentencing extend beyond personal accountability. This case highlights the urgent need for enhanced regulatory frameworks to safeguard investors and ensure the stability of the cryptocurrency market. As institutional and retail investors alike navigate the increasingly complex crypto landscape, the lack of clear regulations can lead to devastating financial consequences. Kwon’s actions and the subsequent fallout have amplified calls for greater scrutiny and oversight from regulatory bodies worldwide.

The Future of Regulatory Measures in Crypto

As the cryptocurrency market continues to evolve, the fallout from this case may act as a catalyst for change. Policymakers and regulators are now under pressure to establish clearer guidelines that promote transparency and accountability among crypto projects. A well-regulated environment could foster greater investor confidence and potentially stabilize the market in the long run. Furthermore, the Terra incident serves as a cautionary tale for entrepreneurs in the crypto space, emphasizing the importance of ethical practices and rigorous risk management.

In conclusion, while the sentencing of Do Kwon is a significant step in addressing the consequences of the Terra collapse, it also opens up discussions about the future of cryptocurrency regulation. As the sector matures, stakeholders must prioritize accountability and transparency to ensure a sustainable and secure environment for innovation.

For more information on regulatory developments in the cryptocurrency industry, you can visit [CoinDesk](https://www.coindesk.com/) or [CoinTelegraph](https://cointelegraph.com/).