🔥 Key Takeaways

- A court in Guernsey upheld a German forfeiture order, seizing approximately $11.4 million in assets linked to the OneCoin crypto fraud.

- The funds were traced to a Guernsey-based entity, Rock Foundation, which held accounts at the now-defunct Egbert Taylor Bank.

- This ruling marks a significant victory for international cooperation in prosecuting crypto-related financial crimes.

- OneCoin, dubbed the “Cryptoqueen” scam, defrauded investors of an estimated $4 billion globally.

Guernsey Court Upholds Forfeiture in OneCoin Case

In a significant development for international crypto enforcement, the Royal Court of Guernsey has upheld a German forfeiture order related to the infamous OneCoin fraud. The court authorized the seizure of approximately $11.4 million held within the jurisdiction, linking the assets directly to proceeds generated by the global Ponzi scheme.

Tracing the Funds: Rock Foundation and Egbert Taylor Bank

The seized assets were held by an entity named Rock Foundation, which operated accounts at the Egbert Taylor Bank—a financial institution that has since ceased operations. German authorities successfully demonstrated that these funds were directly traceable to the OneCoin scheme, leading to the forfeiture order. The Guernsey court’s decision validates these findings, emphasizing the jurisdiction’s commitment to tackling financial crime.

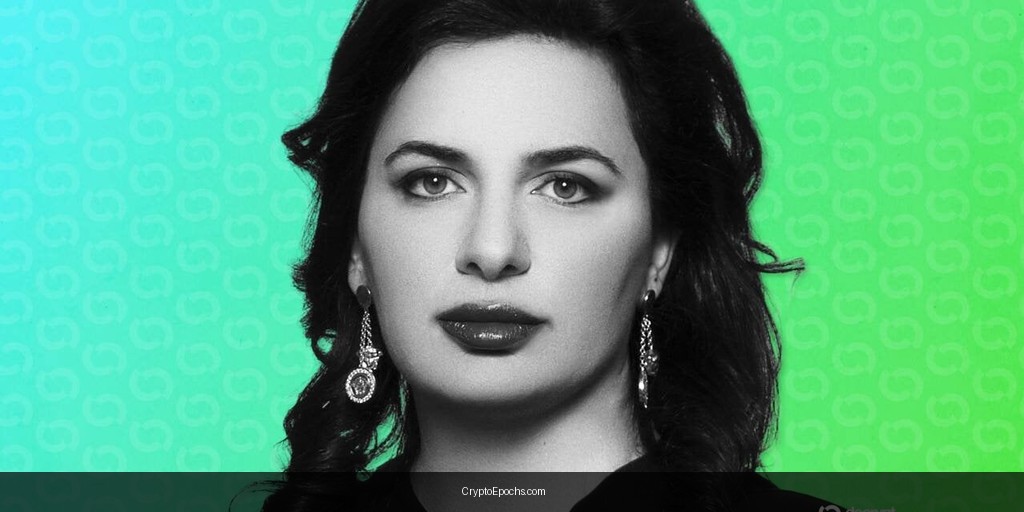

The Shadow of the ‘Cryptoqueen’

OneCoin was founded by Ruja Ignatova, known as the “Cryptoqueen,” who disappeared in 2017. The scheme marketed itself as a legitimate cryptocurrency but operated as a classic multi-level marketing (MLP) Ponzi scheme, defrauding investors out of an estimated $4 billion. While Ignatova remains at large, this seizure represents a tangible step toward recovering stolen funds.

Implications for Global Crypto Regulation

This ruling highlights the growing effectiveness of cross-border legal frameworks in addressing crypto fraud. As regulatory bodies worldwide tighten oversight, the ability to trace and seize illicit digital assets—or fiat assets held in offshore accounts linked to crypto crime—sells a strong message to bad actors: jurisdictional arbitrage is becoming increasingly difficult.