🔥 Key Takeaways

- SEC Chair Paul Atkins clarifies that not all ICOs are deemed securities.

- Token sales can be classified outside the SEC’s jurisdiction under specific conditions.

- This distinction could foster innovation while maintaining regulatory oversight.

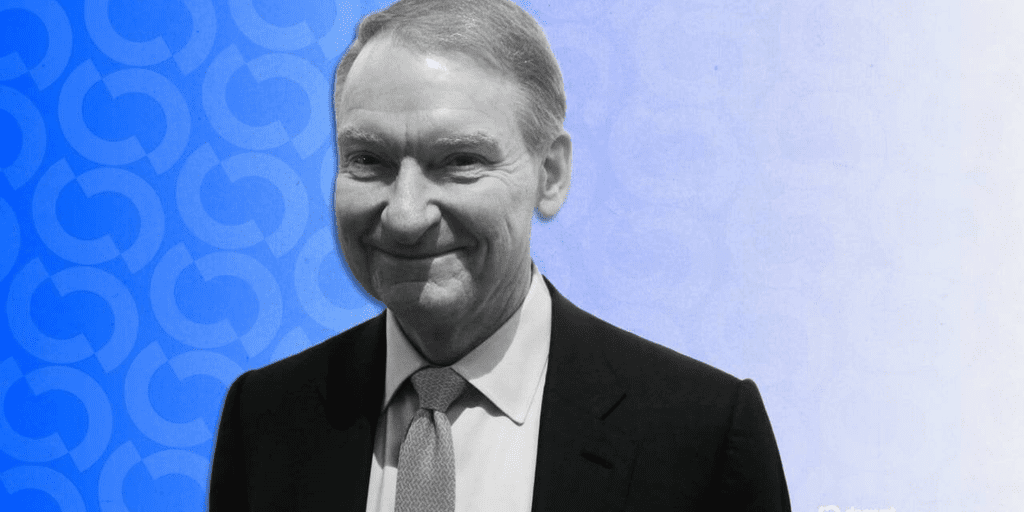

Understanding the SEC’s Position on ICOs

In a recent statement, SEC Chair Paul Atkins provided insight into the agency’s stance regarding Initial Coin Offerings (ICOs). His remarks highlight a crucial shift in how the U.S. Securities and Exchange Commission perceives certain types of token sales. Atkins emphasized that many ICOs do not automatically fall under the SEC’s purview, particularly if they do not meet specific criteria that categorize them as securities offerings.

The Implications of This Clarification

The SEC’s position is significant for the broader cryptocurrency landscape. By delineating which ICOs are exempt from regulatory scrutiny, the SEC may be paving the way for a more vibrant innovation ecosystem. This development is particularly important as it allows blockchain projects to explore funding options without the burdensome compliance requirements typically associated with securities. It encourages entrepreneurs and developers to engage in fundraising activities without fear of immediate regulatory repercussions.

Why It Matters

This clarification from the SEC is a double-edged sword. On one hand, it can stimulate innovation and attract new projects to the crypto space, potentially leading to a surge in technological advancements and market growth. On the other hand, it raises questions about consumer protection and market integrity. Without clear guidelines, there is a risk of misuse, where ill-intentioned projects may exploit this ambiguity to launch fraudulent ICOs. It remains imperative for both regulators and market participants to establish a framework that balances innovation with adequate investor protections.

Overall, the SEC’s evolving stance signifies a recognition of the unique nature of cryptocurrencies and their potential to operate outside traditional financial systems. As the market matures, ongoing dialogue between regulators and the crypto community will be essential to ensure that the evolution of digital assets aligns with both innovation and regulatory integrity. For further insights into the implications of regulatory decisions, you can refer to SEC’s official website or the latest updates on CoinDesk.