🔥 Key Takeaways

- Thailand’s crackdown on illicit Bitcoin mining highlights escalating regulatory measures in Southeast Asia.

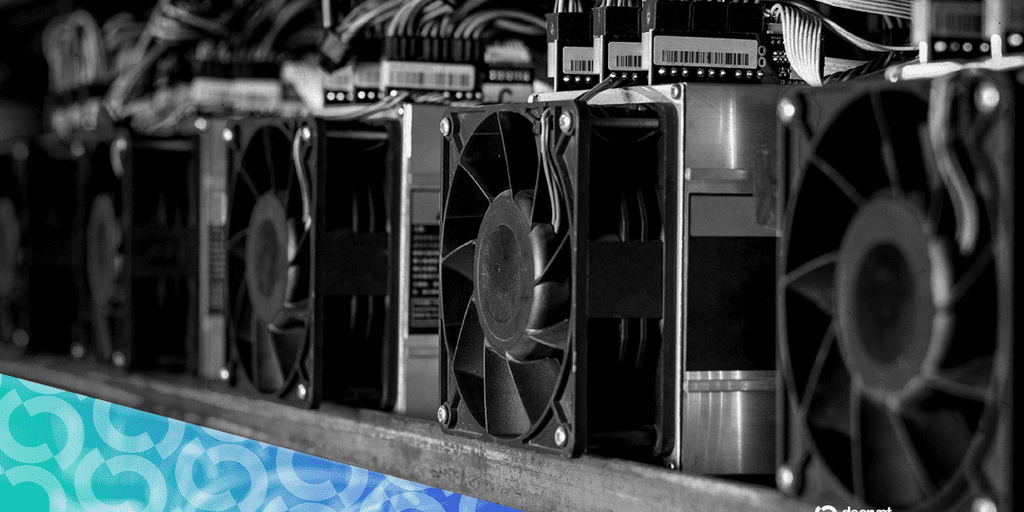

- Unregulated mining operations are straining local infrastructure and contributing to broader cybercrime syndicates.

- The situation reflects a growing global concern over the environmental and economic repercussions of cryptocurrency operations.

Understanding Thailand’s Regulatory Crackdown on Bitcoin Mining

Thailand has recently initiated a significant crackdown on what authorities are describing as an extensive network of illicit Bitcoin mining operations that are allegedly financing Chinese scam networks. The total value of these operations is estimated at around $8.6 million, illustrating the scale of this illicit activity. Southeast Asian nations, including Thailand, are increasingly poised to confront the dual threats of energy mismanagement and cybercrime, which have been exacerbated by the rapid rise of cryptocurrency and blockchain technology.

The ‘Why It Matters’ Section

The implications of this crackdown extend beyond Thailand’s borders. As cryptocurrency mining continues to proliferate, it becomes increasingly critical for nations to strike a balance between fostering innovation and safeguarding their infrastructure. Illegal mining operations, by siphoning off resources from local grids, not only threaten energy stability but also contribute to a broader cycle of cybercrime that can have devastating effects on both individuals and businesses. This regulatory focus may signal a broader trend among governments in Southeast Asia to bolster their cybersecurity laws and frameworks, ensuring that emerging technologies do not become tools for illicit activities.

Global Implications and Future Trends

The unprecedented rise in cryptocurrency popularity has led to both positive innovations and unforeseen challenges. Governments worldwide are grappling with how to regulate this dynamic sector effectively. Thailand’s actions are emblematic of a larger movement aimed at dismantling criminal networks that exploit the anonymity and decentralization benefits of cryptocurrencies. As South Asian nations ramp up their enforcement efforts, we can expect to see a more structured regulatory environment emerging. This could involve not only stricter enforcement against illegal mining but also clearer guidelines for legal operations, ultimately promoting a more sustainable and responsible approach to cryptocurrency.

Moreover, this situation highlights the pressing need for the cryptocurrency community to engage with regulators and provide insight into sustainable practices. Innovators and miners can potentially play a pivotal role in shaping a regulatory landscape that supports both technological advancement and environmental stewardship. The growing importance of responsible energy usage in mining will likely influence investor sentiment and market dynamics, especially as public scrutiny increases.

In conclusion, Thailand’s crackdown on illegal Bitcoin mining operations serves as a cautionary tale for the cryptocurrency industry at large. As governments adapt to the challenges presented by digital currencies, the potential for a more stable and regulated environment may emerge, benefiting both legitimate businesses and consumers.