🔥 Key Takeaways

- The U.S. DOJ is seeking a maximum of 12 years for Do Kwon, citing recent legal precedents.

- This case highlights the increasing scrutiny on crypto founders and the potential consequences of regulatory non-compliance.

- The outcome could set significant precedents for the future of cryptocurrency regulation and enforcement.

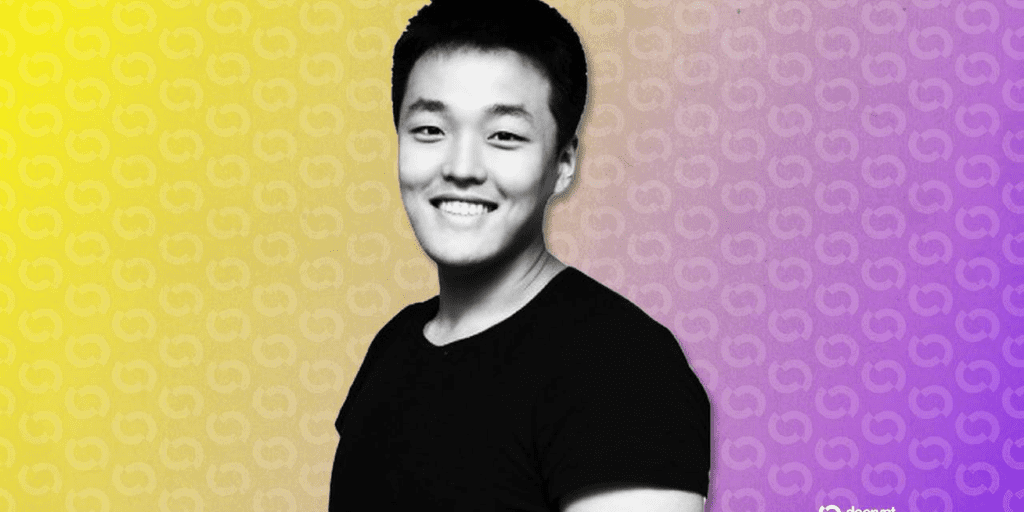

The Context of the Case Against Do Kwon

In a striking development that underscores the *seriousness* with which authorities are treating misconduct in the cryptocurrency space, federal prosecutors are pushing for a maximum sentence of 12 years for Do Kwon, the founder of Terra. This action follows an August plea deal, wherein prosecutors reserved the right to seek this maximum term. The motivations for such a severe penalty appear to be significantly influenced by the recent sentencing of Sam Bankman-Fried (SBF), which has set a precedent for accountability in the crypto industry.

Why It Matters

The pursuit of a lengthy sentence for Kwon is more than just a legal maneuver; it signals a *shift* in how regulators view cryptocurrency founders and their responsibilities. As the market grapples with issues of trust, stability, and legality, this case could serve as a *cautionary tale* for other entrepreneurs in the space. It serves as a reminder that the stakes are high and that regulatory frameworks are becoming increasingly stringent.

Implications for the Crypto Ecosystem

The implications of this case are manifold. First, it draws attention to the *growing scrutiny* from regulatory bodies, not just in the United States but worldwide. The SBF case, which resulted in a significant prison sentence, has already influenced public perception and legislative approaches towards crypto. The push for a similar sentence for Kwon indicates a willingness to enforce *severe penalties* for those who are perceived to have misled investors or engaged in fraudulent activities.

Moreover, the outcome of Kwon’s case may inspire a more *proactive* stance from crypto entrepreneurs regarding compliance and transparency. As the market matures, the emphasis on regulatory adherence will likely become a central tenet of business operations within the space. Investors will undoubtedly be watching closely, as the ramifications could affect their confidence in crypto assets.

A Forward-Looking Perspective

As we analyze the trajectory of this case, it’s essential to consider the broader implications for the future of *cryptocurrency regulation*. Should the DOJ succeed in obtaining the maximum sentence for Kwon, it may embolden regulators globally to adopt similar stances. Such moves could lead to a more regulated environment, which might ultimately benefit the industry by fostering greater investor confidence and legitimacy.

In conclusion, the prosecution of Do Kwon may prove to be a pivotal moment in the evolution of crypto regulation. The outcomes will likely reverberate through the market, influencing everything from investor sentiment to the operational strategies of crypto businesses worldwide. It is a critical juncture that could define the *future landscape* of cryptocurrency and its regulatory framework.