🔥 Key Takeaways

Coinbase CEO Predicts Banks Will Embrace Interest-Paying Stablecoins

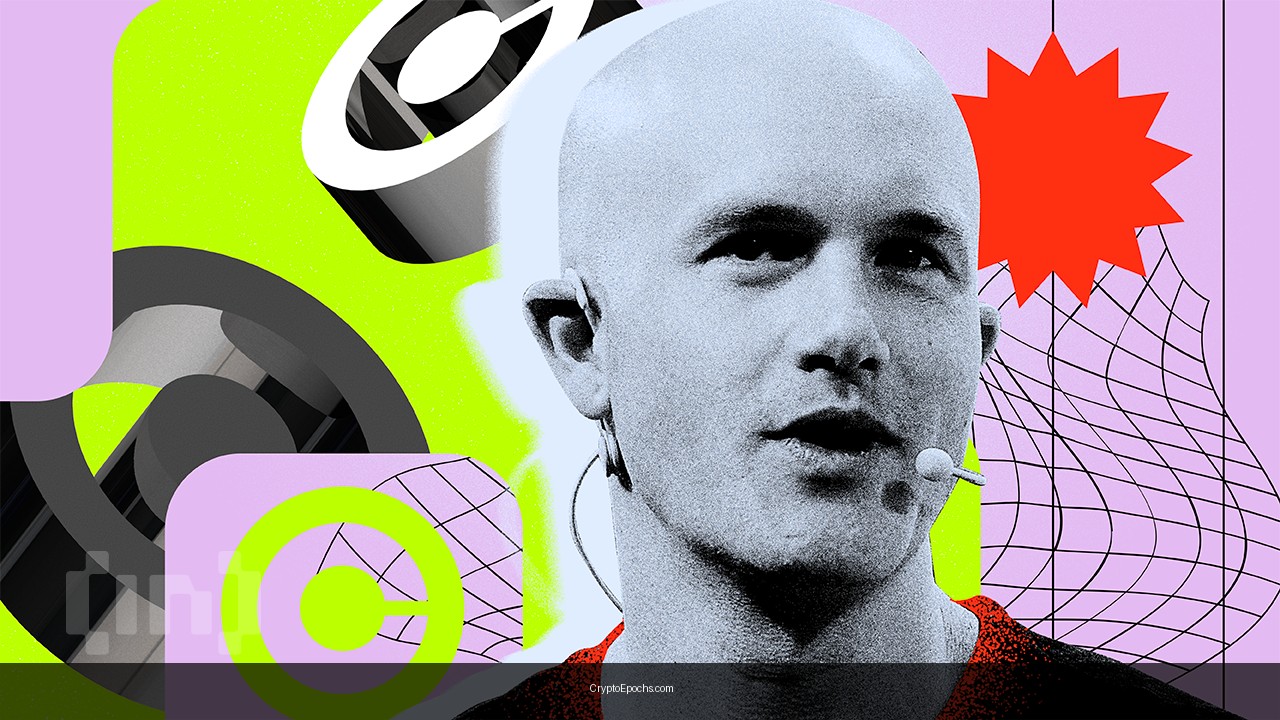

The financial landscape is evolving rapidly, and the intersection of traditional banking and cryptocurrency is becoming increasingly apparent. In a recent statement, Coinbase CEO Brian Armstrong shared his belief that banks will eventually issue their own tokenized dollars, driven by the unsustainability of holding deposits at near-zero interest rates. This prediction highlights a potential paradigm shift in how banks interact with digital assets, particularly stablecoins.

Stablecoins, which are cryptocurrencies pegged to stable assets like the US dollar, have gained significant traction in recent years. They offer the benefits of blockchain technology—such as fast, low-cost transactions—while minimizing the volatility associated with other cryptocurrencies. However, Armstrong’s assertion goes a step further, suggesting that banks could leverage stablecoins to offer interest-bearing products, thereby attracting customers in a low-yield environment.

This move could mark a turning point for the banking sector, which has historically been cautious about embracing cryptocurrencies. By issuing their own tokenized dollars, banks could bridge the gap between traditional finance and the crypto ecosystem, offering customers the best of both worlds: the security and regulatory oversight of traditional banking with the innovation and efficiency of blockchain technology.

Armstrong’s prediction also underscores the growing importance of stablecoins in the broader financial system. As banks face increasing pressure to innovate and remain competitive, interest-paying stablecoins could emerge as a key tool for attracting and retaining customers. This shift could accelerate the adoption of digital assets and further legitimize the role of cryptocurrencies in global finance.

While the transition to tokenized dollars may not happen overnight, Armstrong’s vision highlights the potential for collaboration between traditional financial institutions and the crypto industry. As banks explore new ways to meet customer demands and adapt to changing market conditions, interest-paying stablecoins could play a pivotal role in shaping the future of finance.